Safran Seats & Interiors, Copart Buyers, Games Workshop, SaaS AI Risk

Published Last Week

In 2017, Safran acquired Zodiac for 9.7bn EUR. After Safran shareholder protests, the price was reduced to 8.7bn EUR. Last month, reports circled that Safran is selling a large part of the former Zodiac assets from its 3bn EUR interiors division, excluding seats, to focus on higher-margin jet engine products.

This interview with a former Safran executive, who spent over 30 years at the company, explores the history of the Zodiac acquisition and Safran’s interiors strategy.

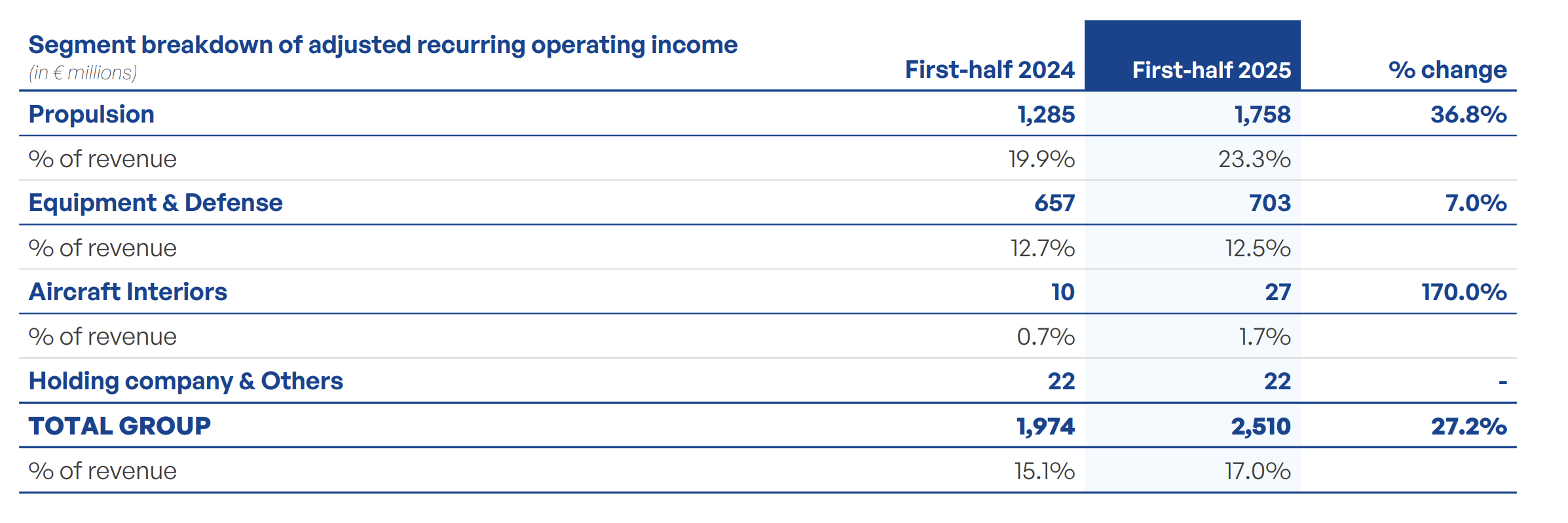

Safran’s Interiors segment includes seats, galleys, overhead bins, toilets, and other cabin equipment. The segment generates ~3bn EUR in revenue and is roughly breakeven:

The Zodiac acquisition seems to have been a mismatch with Safran from the start given the different products, sales cycles, and end customers:

There's a significant cultural gap between Safran and Zodiac in terms of how they work, function, and think, as well as how their markets operate. These are very different markets, especially when dealing with airlines versus products like engines, landing gears, and nacelles. These are distinct from dealing with seats. The thinking and time frames are different. For engines and landing gears, you're considering the long term. For seats, the time frame is five years maximum, maybe 10 if you're not using your aircraft much or you're a low-cost flyer making economies. The first part of this is the time frame. The second is who is buying and making decisions for cabin suitability, which is also very different. - Former Safran Executive

Since the acquisition, Safran has been consolidating underperforming Zodiac sites and driving interior supply chain efficiencies. Cabins have more standard parts than seats which has led the interior portfolio to recover faster than seats:

They have turned cabins around a lot faster than seats because the interiors, the cabins, have more common elements than seats. The variety of seats operated within airlines is phenomenal, and it's very much the image of an airline. Yes, you can have variants in the cabin, but they're not as visible or important in terms of perception. Former Safran Executive

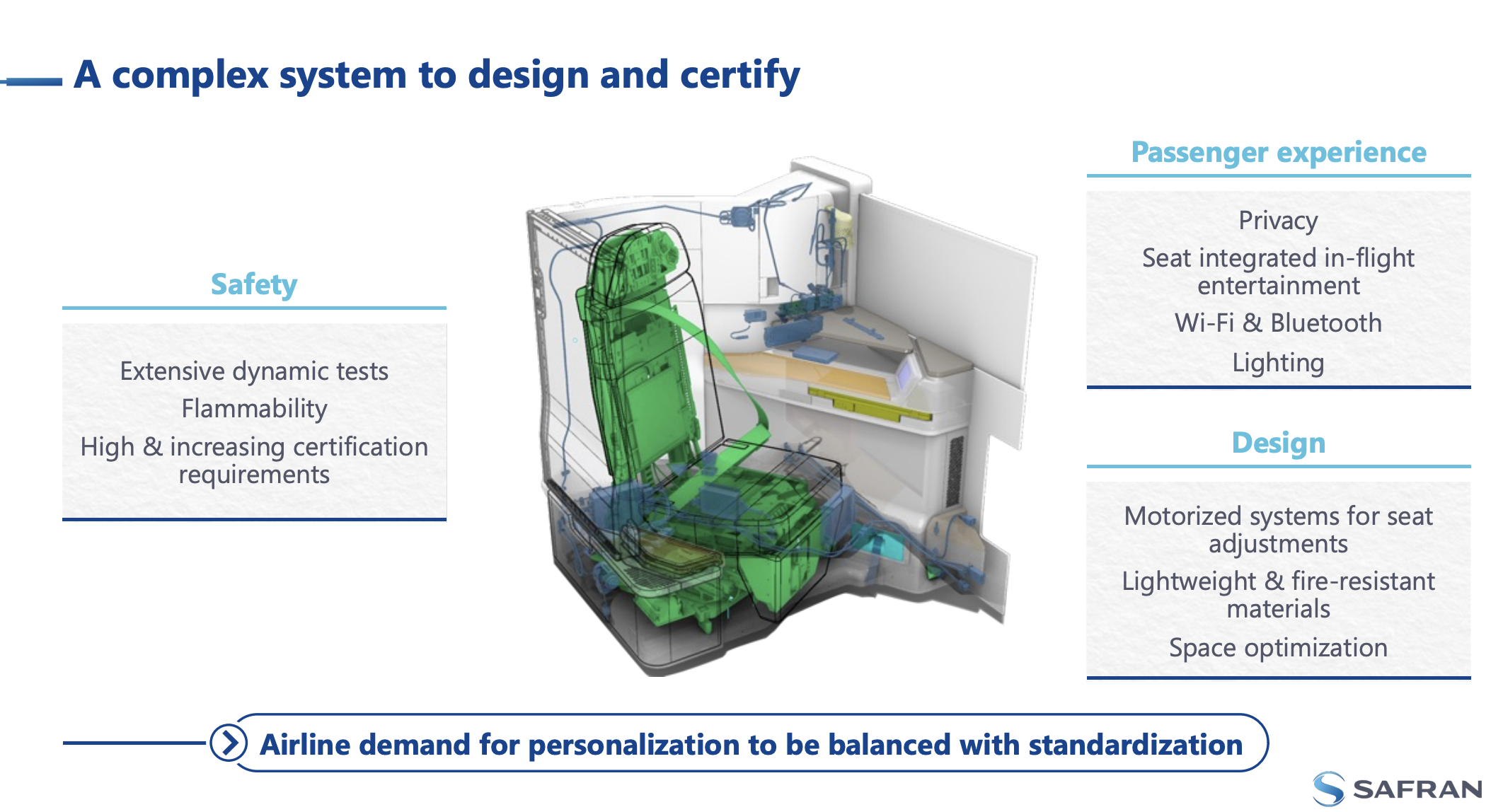

Seats are BFE, Buyer Furnished Equipment. It's the one piece of equipment that has a large impact on the passenger experience that the airline controls. This leads most seats to be customised to each airline which increases certification costs and adds complexity into the seat supply chain:

Safran are on a journey to standardise its seat platforms in economy and business to drive margins:

Almost every airline is customized. That's one of the big challenges. It was part of the culture with Zodiac and has been a challenge for which Safran has tried to address. They aim to standardize some parts and have adjustable platforms. They are making serious progress in standardizing basic seat parts while keeping visible cosmetic parts specific to airlines. This facilitates time to market, certification, cost, and supply chain. Having a shared platform is important, and they've been working on it heavily. Other companies have one platform and change cushions, colors, trimmings . With Safran, you have a lot of bespoke equipment, whether it's first class, business class, or premium economy, or economy per airline. - Former Safran Executive

The aircraft seat market also has many competitors with more standardised and competitive platforms:

In the seats market, it's highly competitive, unlike landing systems where there are only two or three key players. In seats, if I were to list them, I could easily name 10 to 15 companies. For example, ZIM and others. There are many competitors, especially in the economy class seats, with some focusing on business class. Their strategies vary; some use old technology with new designs to keep costs down. Collins, RECARO, Geven, Lufthansa Technik, Thompson, Adient, Stelia, Genco, ZIM, Aviointeriors, Panasonic, Arco. They're the ones that just came to mind. - Former Safran Executive

The interview goes on to explore the interiors portfolio, replacement rate and spares for seat armrests and cushions, and challenges carving out the non-seat interior assets.

This interview can be read alongside the following:

This former Roper VP, who has a background in running legal and healthcare software companies, provides a critical perspective on why AI may disrupt software more than many are expecting.

Your question might be whether it's too sticky for a law firm to stick to custom-built legal practice management software or for a hospital to stick with hospital management software. My answer is that this stickiness is becoming more diluted. It won't remain sticky, and you will see the results in two to three years, not even five. - Former VP at Roper

Why?

Two reasons are suggested by the executive:

- Customers are now more tech-savvy and willing to change

- New entrants are providing more efficient workflows

On customers demanding a better UI and new entrants competing with Cerner and Epic:

The end users of Cerner were resistant to change, which contributed to its stickiness. Secondly, there weren't many competitors willing to enter the market. Many people believe, as you do, that it's hard to compete with Cerner, Epic, and InterSystems. Competing is challenging because the sales cycle is long, typically six to nine months, even for a midsize hospital. Who is going to invest all that money to build software and then compete with Cerner and Epic? They already have a significant market share. Both points have changed. As I mentioned, the end users are now changing. The doctors entering hospitals want something that feels like Uber, Airbnb, or Facebook. This wasn't the case before Covid. After 2023, there has been a significant shift with many new players emerging. - Former VP at Roper

The executive also suggests that switching providers is cheaper today due to cloud infrastructure and solutions:

Previously, before Covid, there was a lengthy sales cycle, and the migration costs, such as database migration, were much higher due to a lack of automation. For example, moving data from a sticky database to another was more challenging because there was less adoption of MongoDB, Cosmos DB, or Azure, which offered fewer cloud features and functionalities. Now, migration is much simpler than it was six years ago. The cost has significantly decreased. If the cost was a million dollars six years ago, it's now less than half a million dollars, easily more than a 50% reduction. - Former VP at Roper

This can be read alongside the following on a similar topic:

This interview with an international salvage buyer on Copart's platform provides an interesting perspective of the economics of purchasing a car and importing from the US abroad.

The unit economics of importing a vehicle from Copart US to Guatemala is as follows:

$1,000 bid + $500 fees + $1,500 U.S.–Guatemala transport + $200 taxes + $500 repair = $3,700 landed cost; sell at $5,000; 15-20 % blended margin

Import costs drive ACV which leads to imported cars being repaired and retailed versus sold for parts:

Just importing a car involves costs like shipping, which add about 30-40% to the car's value. So it's too expensive to buy a car at Copart, import it to Guatemala, and then sell it for parts. The business model isn't viable. There are people selling parts here in Guatemala, but they might have direct contacts in scrap yards in the U.S. or Mexico and ship parts through other means. Honestly, I'm not entirely sure how they do it, but I'm 90% sure it's not by buying at Copart and selling parts here. - International Car Buyer on Copart

This interview can be read alongside the following interviews:

We continue to explore the following questions on Copart vs IAA - feel free to reach out if you'd like to discuss any of these topics:

- Given Progressive’s growth and carriers wanting to level the playing field between CPRT and IAA, how much market share may CPRT lose and how quickly (given there are large outstanding RFPs from top carriers)?

- How accretive are potential synergies frmo CPRTs physical and Purple Wave's online footprint? How can this offset CPRT market share loss?

- The threat of local salvage yard operators in international markets?

- How is the EU market different from the US in terms of a) insurance carriers’ relationships with salvage operators and b) competition from market places when it comes to disposing totalled cars?

A Former Games Workshop executive explores why the company may have made a mistake in the approach to monetising its IP via TV:

"Trust is essential on both sides. However, it became apparent that the focus was on selling Warhammer to the highest bidder to make something. Personally, I think that's the wrong approach to developing shows and building a relationship with a streamer.Kevin used to ask me, "So, how much money have you made me?" I would respond, "Kevin, have you read my six-slide presentation from my interview? It's about investing, a year of development, selecting the right partner, and then creating something to release in the marketplace. It's a two-year cycle." He would reply, "I just want some cash. You're costing me money." That was the backdrop to the deal, which was very awkward - - Former Executive at Games Workshop

And on Cavill's vision for Warhammer:

"Regarding the TV projects, who knows what they're working on? I have my thoughts, and it might be a misstep, but Henry Cavill wants to make a story about the Horus Heresy. Is this too much detail? The Horus Heresy is the story of the Emperor, and it's vast. I think there are 19 books in the series. There are so many books, and starting there is the absolute worst place. Henry Cavill wants to play the Emperor and be the star, which I think is a mistake. I hope they're not doing that because telling the Warhammer story that way would be too complex for casual audiences. It would cost hundreds of millions of dollars. I've told Henry not to do that. Instead, focus on something more accessible, character, and story-driven with other characters in the lore. They'll do one thing in 2027, and if it works, they might accelerate. They could develop projects from different areas of the grimdark universe and roll them out over two or three years - Former Executive at Games Workshop

Another interesting comment highlights how even employees are "fanboys" just as much as its customers:

I was impressed with the culture and the people. Everyone's a fanboy, which you could discount a little. Everyone at Games Workshop is a hobbyist and plays Warhammer. What I wasn't expecting was how deeply ingrained Warhammer is in their culture. The only people who aren't hobbyists are those working in the factory, like on the machines, but they become fans too. It's a unique ecosystem where everyone loves it. Games Workshop's senior management knows this, so they can pay less and somewhat exploit their workforce. However, as business people, it's a good model if people are happy and not complaining. There's a balance between culture, giving freebies, making it a fun and cultural place to work, and being surrounded by Warhammer every day. - Former Executive at Games Workshop

This can be read alongside a prior interview on Games Workshop: Wargaming IP; a review of intellectual property, pricing, and 3D printing risk.

Related Content

Constellation Software: UK Healthcare VMS & Selling to the NHS

Former Senior Executive at Constellation Software

AWS: Securing Grid Power for Hyperscale AI Data Centers

Former Executive Leader, Energy Strategy and AWS Infrastructure at Amazon

Airbus A320: SOFITEC Panel Issues & 2025-2027 Production Impact

Former Director at Airbus

GKN Aerospace: RRSP Economics, GTF Cash Flow & Path to £600m

Former Chief Financial Officer at GKN Aerospace

© 2024 In Practise. All rights reserved. This material is for informational purposes only and should not be considered as investment advice.