We continue on our mission to build the world's best destination for long-term investors to study and understand businesses. We believe that conducting world-class primary research is one of the most effective ways to explore the core drivers of a business and investment thesis.

We live by this belief; last year, our internal research team conducted ~400 interviews with former executives. We are our own largest customer. IP was originally built to serve our own needs and has evolved to provide our executive sourcing infrastructure to hedge funds globally.

As LLM adoption grows, the input quality of any system matters more than ever. High-quality source information is critical. Our business continues to focus on quality inputs over quantity. To maintain the quality of our interview library, we are focused on two simple, but tricky, input variables:

- Interview questions: we limit which investment managers may conduct interviews through our platform

- Interview answers: we've designed our business to source only the most relevant executives

While IP started as an operation to source executives for our own research, we now work with ~80 top investment firms and growing. We work with funds that have a relatively concentrated portfolio, low-portfolio turnover, sector expertise, and are focused on conducting world-class primary research. Over the last few years, we've regularly referred firms to competitors who we don’t believe match these characteristics. And we plan to be increasingly more selective. This protects the quality of the questions (input 1) in any interview we publish to our library.

In the last year, we’ve almost doubled the size of our research team focused on sourcing former executives. We aim to build the best executive sourcing infrastructure globally. As our own largest customer, we’ve designed our infrastructure, executive vetting process, and team to source the most relevant executives. And relevant often doesn’t mean seniority; some of the best interviews we’ve conducted were with candid, relatively junior executives closer to the action than polished C-suite leaders. The more relevant the executive, the higher-quality the interview answers (input 2), the greater the value of our library.

In 2025, we doubled the size of the library. In 2026, we aim to continue growing while maintaining the quality of both inputs above.

Thanks for your continued support to make it possible for us to continue this work. You maintain our commitment and dedication to continue producing a high-quality research library and tools to help you learn and build conviction.

Most Popular Articles in 2025

IP Research Articles Published in 2025

In 2025, around 25% of the material published on our platform was conducted by our internal research team. From the ~400 hours of interviews we conducted last year, we curate our learnings into written research pieces to save you time:

IP Hardback Volume 1 Physical Book

We have the last remaining copies of our first edition hardback book available on Amazon for those in the US or UK. The book curates a number of our favourite interviews over the last five years including:

- How Costco buyers work with suppliers, manage categories, and drive dollars per pallet.

- The history of US wine and spirits distribution since Prohibition and scale benefits of Pernod Ricard and Constellation Brands

- How Domino's scales its network to dominate local markets

- Constellation Software's best-in-class processes to operate vertical market software companies

- How Universal Music works with artists and Spotify's bargaining power in the music value chain

- TransDigm's value-based pricing techniques and operational processes

- The history of PlayStation and Nintendo's approach to building durable intellectual property

- How LVMH and Goyard, the two oldest luxury leather companies globally, distributes product whilst maintaining brand equity

- How Sunbelt and United Rentals leverage economies of scale to consolidate the equipment rental market

- A practical account of how Danaher deploys its Business System across the group

- How Zara sources raw material, manufactures, distributes, and merchandises product compared to SHEIN

This interview shares a bear case on VMS companies due to the threat of AI:

Your question might be whether it's too sticky for a law firm to stick to custom-built legal practice management software or for a hospital to stick with hospital management software. My answer is that this stickiness is becoming more diluted. It won't remain sticky, and you will see the results in two to three years, not even five. On one side, end users have become more tech-savvy and aware. On the other, startups are disrupting the market by automating boilerplate templates and workflows. Users no longer have to stick with software that has many issues and bugs because there are now competitors. If you are asking whether old horizontal software companies will stick around because it's hard to get rid of them, I believe they will lose their presence. By 2030, I expect the market share of these horizontal software companies to decrease by at least 30 to 35%. I am being conservative; it could be much more. - Former VP at Roper Technologies

Published earlier this year, this interview has a similar tone to recent critics highlighting the risk of an action-oriented new agentic layer that can make decisions across enterprise systems. Such an agent can potentially add and capture more value than a traditional SaaS ERP that is a system-of-record. Vertical-focused LLM-agent software and how incumbents are positioned is a core theme of research for us in 2026.

Last year, we also deepened our understanding of Constellation’s operational playbook covering two specific topics:

- How it sources deals vs competitors: Constellation Software, Vitec, & Röko M&A Sourcing: Proprietary vs Broker Channel

- How it incentivises M&A staff and the impact on organic growth: Constellation Software: Incentive Structure & Organic Growth

We explore why and how CSU sources the majority of deals directly:

What most people need to understand is Constellation is seeing a lot of these opportunities before anyone else gets a look. Generally speaking, it's one-to-one; they're not shopping the business. I would say about 65% to 70% [of deals are proprietary]. - Former M&A Director at Constellation Software

And the value of its company pipeline database:

What most people need to understand is Constellation is seeing a lot of these opportunities before anyone else gets a look…This is the greatest thing about Constellation. They have a Salesforce database of around 60,000, 65,000, 70,000 or however many software companies. Basically, every software company in the world is included…this is all in Salesforce, which I have access to from day one at Constellation. - Former M&A Director at Constellation Software

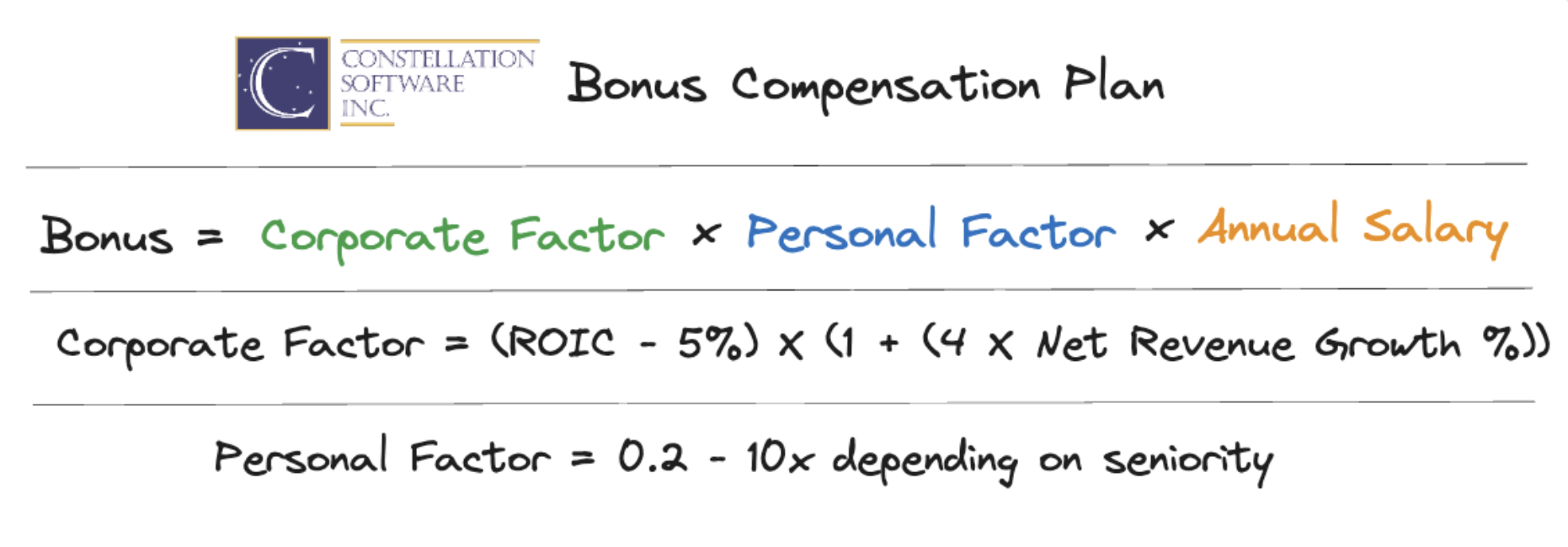

We break down the core incentive variables for Constellation M&A staff:

We walk through the math of a real-world example of a Group Leader weighing up the option of acquiring companies or driving organic growth under the company’s Keep Your Capital scheme.

I was managing a £20 million portfolio with a 35% profit margin. That's about £7 million in profit. I had to deploy around £5 million of that annually. That's a lot of [organic] initiatives I need to fund to deploy my capital because initiatives come off your target. So, I'd have to decide to spend £5 million a year in R&D with no guaranteed return or I could buy or acquire one business. It’s easier to acquire companies. - Former Group Leader at Volaris

This work can be read alongside the following:

The last interview above provides a different perspective by comparing Vista Equity’s post-acquisition playbook to CSU:

I would say 75% to 80% of the thesis in most Vista investments is focused on growth. That was a different time, and it might be different now, which I can discuss. In their first 20 to 25 years, Vista was always focused on coming in and really changing the organization and strategy to focus on growth. Growth activities included improving the efficiency of the sales organization by bringing in the right talent and having the right training programs. The sales team needed to be properly trained, focusing on the fundamentals of what makes a good sales organization and sales training. They invested a lot in that, which fueled growth. - Former Value Creation Director at Vista Equity

NVIDIA GPUs and custom ASICs

A Former Chip engineer at Google and Groq explores how NVIDIA may continue to dominate in training due to CUDAs flexibility:

The software stack doesn't matter too much for inference because inference is a fixed thing. The customer basically just has an API interface. For inference, it doesn't matter how bad the software stack is, like with a company such as Cerebras. But for training, especially for large-scale pre-training, it matters quite a bit. The main reason xAI probably hasn't done a deal yet with Google's TPU is likely because the software stack from the TPU is not as good as the one from NVIDIA… However, it's still early for these companies. Google, for example, is hesitant to open up its instruction set architecture for the TPU. They fear that if they open too much of their software stack, other chip companies could copy what the TPU does. That's why Google keeps it somewhat closed. Eventually, the software needs to be completely open and converging so that end customers can quickly switch from one to another. - Former Chip Engineer at Google

But how they believe custom ASICs from Google and AWS will continue to take share from NVIDIA in inference:

The main difference is that NVIDIA chips are very expensive. NVIDIA charges maybe 10 times more than it costs them to make these chips, while Google might charge only two to four times the manufacturing cost. That's the main difference, and NVIDIA can do that today because they don't have much competition. Both NVIDIA and Google's TPU are comparable in terms of throughput and latency. If those factors are equal, the cost comes down to the chip price and electricity, including cooling. Anything other than NVIDIA is cheaper because no one charges as much for their chips as NVIDIA does. - Former Chip Engineer at Google

Amazon

Two AMZN interviews ranked well this year:

The first interview covers AWS' AI strategy with a Former Director of its Bedrock service:

When ChatGPT was launched, there was significant internal concern about whether AWS would survive in this AI era because AWS did not have anything like ChatGPT at that time.So, we launched something called Amazon Bedrock as a service, and thankfully, I'm a founding member of the team. As a result, we built Bedrock, which we call a platform layer. It's not an infrastructure like Nvidia hardware. Now, Amazon has Trainium and Inferentia as our own hardware. It feels like AWS took a calculated risk, taking their time to ensure the service they launched was not haphazard but done the right way. The strategy is working out because customers today aren't asking for just one model, like ChatGPT. They want options, whether it's an open-source model, a smaller model, or a larger model. We started with five models, and today there are 15 different models, including small and large language models. Because of the abstraction AWS provides, they can swap hardware behind the scenes. Many services and LLMs are running on AWS's own hardware, like Trainium. Regarding strategy, I think it's right because Amazon doesn't think short-term. That's something I learned in my five years there: never think just for a quarter or even just for a year; think long-term and plan backward from there. - Former Generative AI Director at Amazon Web Services

Amazon’s B2B distribution unit, now called Amazon Business, is generating over ~$40bn in run-rate GMV.

Amazon Business is a B2B distributor of commercial, industrial, and healthcare products. It’s estimated that over 50% of the division is selling a variety of long-tail commercial products with the remainder split between healthcare and industrial end markets.

This interview with a Former Leader of the division explores how the company enters new markets and which verticals Amazon is best positioned to disrupt. Amazon seems to be taking share in the commoditized long-tail of each end-market because it's cheaper, faster delivery, and easier for individual plant managers or maintenance technicians to order from Amazon.

For instance, a maintenance technician in a facility might need supplies, find them easily on Amazon Business, and make a purchase. The relationship can start there and potentially expand. You might also see a scenario where a K-12 teacher or a university lab technician with a consumer account realizes they could have a business account. They notice the SKUs are available, create a business account, start making purchases, and the relationship grows from there. - Former Senior Executive at Amazon Business

One outstanding question is how Amazon can adapt its fulfilment network to distribute more complex medial or industrial products:

There is still a lot of untapped opportunity for Amazon, but pursuing these opportunities will require Amazon to decide if they want to engage in more heavyweight white glove services. Does Amazon want to delve deeply into that? Are they willing to have employees manage big accounts or offer these services? If they choose to do that, I think you could see significant developments. If Amazon decides to create specialty delivery fulfillment networks for highly regulated products and offer white glove services, I imagine there would be customers interested in using it. However, it's really up to them to decide. - Former Senior Executive at Amazon Business

This interview can be read alongside other interviews below that cover B2B distributors:

Danaher: Aldevron & DBS

Two DHR interviews were popular last year:

The first is with a Former VP of Sales at Aldevron explores the DNA plasmid manufacturing process and competitive positioning of the company:

There are very few plasmid shops that produce linear DNA at the scale Aldevron does. Others have different mRNA processes. Aldevron makes a GMP supercoiled plasmid, then a GMP linear plasmid, which is used in the mRNA suites to produce mRNA. Some companies take supercoiled DNA, linearize it, and run the IVT reaction all in the same suite. There are advantages and disadvantages to both methods, depending on how you're set up. - Former VP of Sales, Aldevron

And how competition is pressuring Aldevron:

I would say Aldevron still does a good job of dominating the DNA market. However, they've faced headwinds from China-based companies like GenScript, which initially offered services at a fraction of the cost—anywhere from a tenth to a third—compared to US prices. . - Former VP of Sales, Aldevron

This interview can be read with others on Aldevron and plasmid manufacturing and Cytiva:

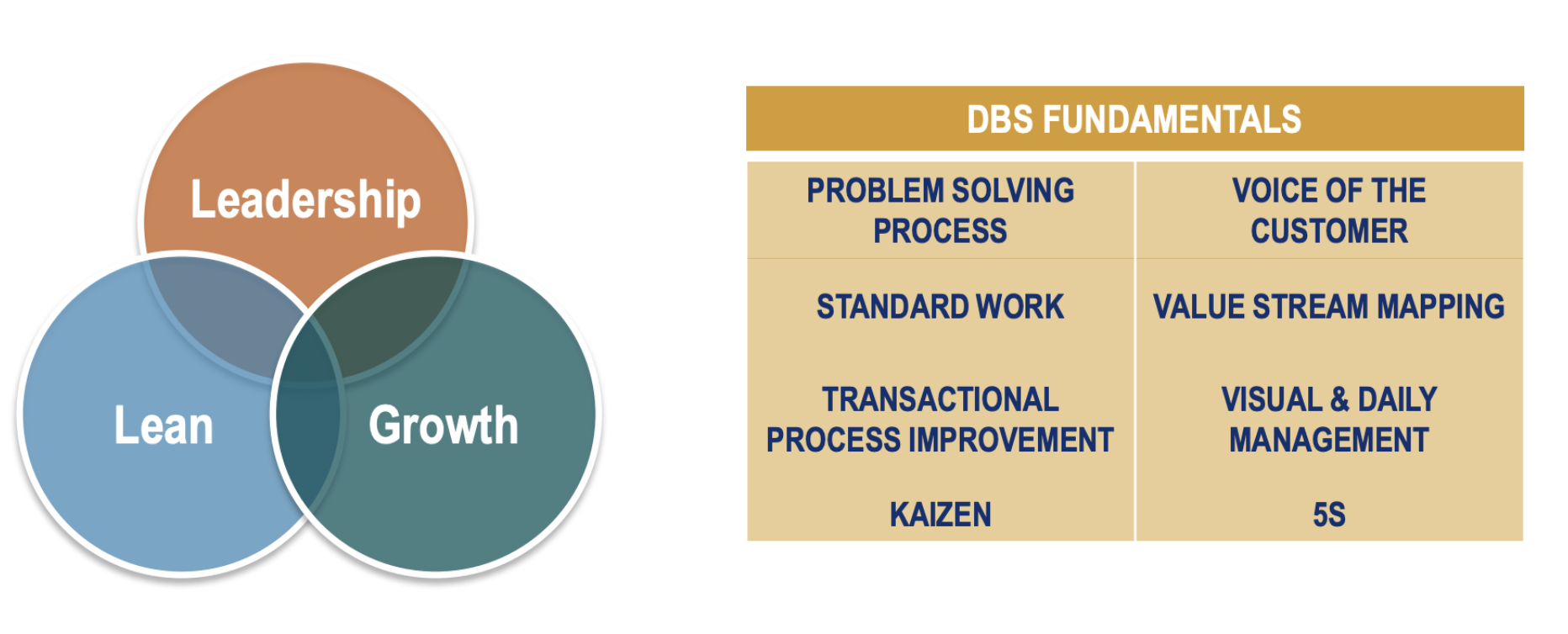

The second article curates all our work on the Danaher Business System.

“The DBS process system is the soul of Danaher; the system guides planning and execution.” – Larry Culp, Former CEO at Danaher

While there are over 100 DBS tools, there are eight fundamental tools that underpin the philosophy:

This article curates some of our work on the topic, explains why we’ve covered certain angles, and shares a few insights from each interview:

- Danaher: DBS Office Structure & Policy Deployment: how the DBS office is structured to deploy DBS tools in Danaher operating companies

- Danaher: DBS Office Operational Strategy: how the DBS deploys policies around the org, incentives for subsidiaries to listen and deploy DBS policies, and barriers deploying such a strategy in other companies

- Danaher Business System: Batch to One Piece Flow Manufacturing: how DHR changes a manufacturing process from batch to one-piece flow post-acquisition

- Danaher Business System: Kaizen Case Study at Pall: a case study of how Danaher runs a Kaizen event at Pall

- Danaher Business System: PSP, Kaizen, & Six Sigma: we walk through how DHR deploys various tools include PSP, different kaizen events, and Six Sigma vs lean tools

- Danaher: Implementing DBS in the Sales Process: how Danaher deploys DBS policies to drive revenue, retention, and improve gross margin

- Danaher Business System: Hach Sales Team Case Study: how Hach deployed daily management, action planning, and cascading targets in sales to drive growth

- The Danaher Business System Mindset: how and why the DBS fosters a unique culture that is hard to replicate elsewhere

- Danaher, Beckman Coulter, & The DBS Machine: how Danaher deployed DBS at Beckman Coulter post-acquisition

- Danaher's Culture, Pall Industrial, & Deploying DBS: why PSP tool is so important and how Pentair and Crane's ‘DBS-light’ system compares to Danaher.

In the last twelve months, Copart’s share price is down over 33%. The company seems to be losing share to IAA, now part of Ritchie Bros. This interview with a Former GEICO Claims Officer, who ran and managed the RFPs to Copart and IAA, highlights the key variable for insurers when selecting a salvage partner:

Speed is the key KPI for carriers because a vehicle loses value the longer it sits. There's everyday volume, like when Steve and Jenna have an accident in the U.S. and a car is totaled. Then there are large-scale events, or catastrophes, usually weather-related, which significantly impact salvage volumes. - Former Claims Officer at GEICO

Speed is especially important during catastrophes because volumes are high and insurers aim to differentiate by resolving claims quickest:

During Hurricane Katrina in New Orleans, Louisiana, I made a decision to trust customers, even if we didn't know where the cars were. We believed they would eventually show up. In a major metropolitan area that had evacuated, waiting too long would put us at a disadvantage. So, we started taking people at face value. Our goal was to have 90% of the cars seen and 90% of the customers paid within two weeks, which was an aggressive model. - Former Claims Officer at GEICO

Today, performance seems very close between the two major players and Progressive and State Farm, the two largest auto insurers, currently have RFPs out for tender:

The insurance industry has always disliked monopolies, and with two new operators at Ritchie Brothers/IAA mix, the industry has been closely observing their actions. They made significant changes, improving speed and, consequently, returns to insurance companies. IAA has improved in some ways, and currently, results across the ecosystem are considered neck and neck. Both Progressive and State Farm have issued RFPs, which are requests for proposals. These are typically sent to vendors or providers to ask for pricing based on volume. Progressive and State Farm have outstanding RFPs with IAA and Copart. This is significant because they are the two largest insurance companies in the country. Progressive is 50% larger than GEICO. A subtle shift in volume with Progressive or State Farm could significantly impact Copart and/or IAA. - Former Claims Officer at GEICO

This interview can be read alongside the following interviews:

Waymo, Uber, and Autonomous Vehicles and Ride-Hailing

Two Waymo interviews were popular last year:

Waymo started a service in Phoenix to gain operational learnings and in San Francisco to keep engineering and customers close. This is fundamentally why companies pursue a first-party end-to-end value chain, from apps to vehicles, software, customer experience, and payment systems. However, there is a significant human capital investment involved. At a certain inflection point, when Waymo gained confidence in its vehicles' scalability and simulation testing, and wanted to accelerate its go-to-market strategy, this operational model became less efficient. This is where partnerships with companies like Uber and Lyft become beneficial. They already have consolidated demand, which lowers customer acquisition costs. - Former Waymo Executive

The interview explores the partnership economics:

If you look at the margins when you allocate a vehicle with minimal human resources and earn, let's say, about 50 or 40 cents a mile over, say, 100,000 miles on average—or maybe that's on the higher side—but even if a robotaxi runs about 80,000 miles a year and you earn 50 cents a mile, you're still generating about $40,000 per vehicle in revenue with minimal overhead. Now, Uber's average revenue per mile is about $4. If you take half of that, you get about $2. So for 80,000 miles a year with an average mile cost of $4, even if Waymo gets half of it, which is $2, each vehicle generates about $160,000 in revenue. That's a significant amount and almost breaks even the BOM cost of the vehicle in a year or less. - Former Waymo Executive

One challenge to scale Waymo lies in the significant R&D required for each new platform:

Here's the problem and why I don't think Waymo's AV1.0 will scale for ride-hailing. You still need one or two more generations of Drivers before you can have longer periods between Driver innovations. Every time you deploy a new Driver, you need a whole new vehicle platform. The I-PACE vehicles with the fourth-generation Driver will be end-of-life in a year or two, and they're essentially throwaways. Right now, there are maybe 1,500 vehicles, but every time Waymo launches a new Driver, they have to develop a whole new vehicle platform, which incurs significant upfront costs that need to be allocated. - Former Waymo Executive

Such high platform R&D costs has led to higher cost per mile vs Uber:

The cost per mile for Waymo is certainly above the Uber average... They are much closer to $2 if you don't allocate the development cost. - Former Waymo Executive

We have various interviews covering this topic in more detail:

Our Wise research was popular last year and an interview with a former Executive at Bank for International Settlements that explores the threat of stablecoins to Wise ranked in the top 10. This interview pairs well with many other interviews on the company:

- Wise: Competition, B2B & Stablecoins: Currencycloud Co-Founder

- Wise: European Bank Platform Perspective: Current Payments Director at Raiffeisen Bank International

- Wise: Stablecoins Threat: Former Executive at Bank for International Settlements

- Wise: Platform Selection Criteria & Economics: Current Director at Mandiri Bank

- Wise Platform vs Visa: Currencycloud Economics: Former VP at CurrencyCloud

- Wise: Revolut FX Margins & Cross-Subsidies: Former Director at Revolut Business

- Wise Platform: Currencycloud Competition: Currencycloud Co-Founder

- Wise: Bypassing Swift: Former Market Infrastructure Executive at SWIFT

- Wise Platform: Raiffeisen Bank Case Study: Current Payments Director at Raiffeisen Bank International

- Wise Platform: Mandiri Bank Case Study: Current Director at Mandiri Bank

- Wise: Platform & Banking as a Service: Former Account Manager at Wise

The interviews highlight a few potential risks to Wise:

If I were starting again with a blank check, I'd create an AI and stablecoin native platform for a fraction of the cost... Ultimately, you'll be left with a much more modern, progressive, adaptable, easily developed, programmable global payments infrastructure. - Currency Cloud Co-Founder

If you're differentiating your service on faster and cheaper, your cost of sale goes up, and your revenue goes down. Well done. But stablecoin is more than that. It's 24/7, programmable, and can be made conditional. - Currency Cloud Co-Founder

Wise needs to have a much broader network. Seventy-plus banks won't suffice for high-value payments globally because you need local banks in all those countries with RTGS, instant payment systems, and other payment infrastructures. Without the reach that SWIFT has, it's going to be very challenging. - Former Market Infrastructure Executive at SWIFT

© 2024 In Practise. All rights reserved. This material is for informational purposes only and should not be considered as investment advice.