The low cost operator business model is a focus for us at IP. We're fascinated by companies that are designed and run to deliver the lowest cost to the customer whilst sustainably capturing value itself to generate high returns. But the model has to be a win-win across the ecosystem otherwise it's fragile. Suppliers, partners, distributors, employees, and other parties in the ecosystem have to also win. You can only squeeze parts of the value chain for so long without it putting the business at risk.

Part of our internal research process at IP focuses on understanding top-performing low-cost operators to help us identify future low cost winners. This IP Research Roundup curates some of our favourite insights from our library on the following low cost operators:

- Aldi

- Amazon

- Carvana

- Costco

- Ryanair

- Wise

This IP Research roundup adds to our collection including:

We’re also working on the following roundups:

- Insurance value chain work: Markel, Kinsale, Progressive, Geico, BRO, RSG

- Great brands: LVMH, Hermes, Brunello Cucinelli, Ferrari

- Vertical software: Appfolio, Veeva, Procore, CCC Intelligent, Kneat, Guidewire

- Bioprocessing: Danaher & Sartorius

- Autos Value Chain: Tesla, Copart, IAA, ACV, Carvana, Carmax, Lithia, CACC

Aldi & Costco

The Price Club, founded in the mid-1970s and later merged into Costco, seems to have learnt a few tricks from Aldi, founded in Germany in the mid-40s. Many other discounters such as Action and B&M have since followed suit. Aldi and Costco deploy many similar operational techniques to sustainably deliver the lowest cost to customers including the following:

- A limited product range

- Fewer SKUs drive deeper buys at better unit prices

- Simplified packaging and merchandising

- Products are mainly displayed as packaged and shipped to the store to save labour costs unpackaging and displaying

- A high Private label mix

- While Aldi sales are ~90% private label vs Kirkland at ~25% of Costco sales, both companies partner with leading brands to manufacture private labels at brand-level quality in return for merchandising the manufacturer’s product in-store.

- A culture with a relentless focus on cost

Limiting the product range is arguably the single most important driver of a discounter’s business model design. Aldi and Costco carry ~2,000 and ~4,000 SKUs, respectively. This is a fraction of the 100k+ at Walmart or Tesco, for example. A narrower range drives bargaining power per SKU to offer the lowest price in the market:

Principle number two is that it stocks a restricted range of products. The restrictions are as follows: they have to be relatively high volume products, so that there is huge scale gained out of selling that item; secondly, that the quality pitch of those items should be where the people who are consuming them currently choose to purchase. It's pretty simple to just buy data that tells you: many more people like an orange juice that is 100% pure, that comes from sustainable sources and has a certain brix level (that's the sweetness level). So you identify 'that's what people want,' and they're proving it by best selling brands being in that space, and the Aldi product has to rival that. - Former CEO of Aldi UK

Both companies limit packaging and merchandising costs by aligning with suppliers and displaying products in cases as purchased:

There are times when delivery drivers for Aldi bring the product to the store and actually put the product on the sales floor, ready for the consumer to buy; it's that efficient... How it is made in the factory is how it's sold in the shop. Whether or not that is a full pallet, which goes straight onto the shop floor and the first person who touches it is the consumer, or a full box, which is transported through the supply chain and placed on the shelf. - Former CEO of Aldi UK

Their approach to driving profitability is also similar. Traditional supermarkets typically aim to drive gross margin by reducing the price of branded products they procure. If they can’t increase front-end margin, retailers charge higher slotting, display, and listing fees to drive back-end gross margin. Costco and Aldi take the opposite approach; they don’t offer listings or slotting. Both companies are aligned with branded and private-label suppliers to reduce the unit cost, increase supplier productivity, and share the cost savings with customers.

Costco is about cost efficiency and saving and their suppliers also need to do that. They benefit because selling to Costco is easy. Most of the time you have one key account manager with almost no team behind them because they can manage it on their own. When selling to other retailers, full time marketing and logistics staff are required due to the complexity. Reducing the complexity reduces the cost to a supplier who passes that saving to Costco who get a better price. It is a ripple effect; the simpler the business and the people managing it, the cheaper the cost. Both Costco and the supplier know that, whereas 20 years ago, the concept was difficult to explain. - Former Buyer at Costco

Both companies also work with brand manufacturers to produce private label products at an equivalent quality at a fraction of the branded product price. Brands agree to manufacture Kirkland in return for distribution of the branded product in Costco stores. Kirkland volume smooths out the manufacturer's production schedule:

Nestlé sell a ton of water at Costco but one day Costco decide to offer private label water. They approach Nestlé and other suppliers but Nestlé refuse because they only do their own brands. Costco still does their private label water and Nestlé lose 20% of their revenue on volume. Nestlé have to make a strategic decision of sticking to their belief of not doing private label and losing 20% to 30% of their volume, or doing private label for Costco, and losing slightly on their brand. There is a love-hate relationship between brands and buyers. Suppliers have the capacity but face a big risk if they do not comply. - Former Buyer at Costco

Kirkland demands a minimum discount from the brand manufacturing the product:

For Kirkland Signature, it needs to be a minimum of 20% value to a branded item, either at Costco or at retail. A branded item, from Costco to retail, should have a similar slope. You have got to show pricing authority because your member, who is shopping with you, is paying to shop with you. There has to be an incentive for them to come and shop with you. They’re not going to come and shop with you if you are giving them the same price, on the same goods, that everybody else is offering. - Former Senior Manager at Costco

These business model design decisions lead to higher returns on equity than average for both companies. Aldi has two-thirds of the gross margin but double the operating margin as competing traditional supermarkets. Costco has ~50% higher turns, lower product gross margins, and higher ROE.

On average, if you just take the store operational expense, which is pretty much the biggest expense any food retail has, it’s half. As a percentage of sales, it’s half what a general supermarket would be. A well-run general supermarket. A well-run general supermarket needs eight percent of its sales to run its business at a store level and an Aldi level can run at four. That’s four-percentage difference. There’s a whole host of other differences across the business, but that’s the biggest single one.- Former CEO of Aldi UK

While business model design is important, it doesn’t last without a culture relentlessly focused on cost. A focus on reducing cost whilst increasing revenue is difficult. We look for a low-cost mentality that permeates each decision made at the company. This story of the Aldi founder is legendary:

The floor that we put into the supermarkets was legendary. We installed a sales floor, which was actually quite expensive from a certain part of Italy because it was, virtually, non-porous. That meant you could spill beetroot juice or red wine on it, it could stay there for 10 minutes and you could just wipe it off. It’s just a really, really dense format. It can also take the weight of one kilonewton. We found other floors, which didn’t have quite the same longevity, that were about 30% cheaper and that was a big part of the construction of the store. If you wanted to alter the floor, which was the same floor everywhere in the world, for Albrecht, that was a big deal. What he wanted to know was, what is the 30 year life cost of this floor, including the cost of cleaning, because you can just whizz over the floor we laid. In 22 minutes, you could do 760 square meters, with a floor cleaning machine. In the end, he was right. The 30-year cost of this floor was cheaper, if you stay with the existing floor tile. For him, it was just common sense. The store is going to be there for 30 years; we’ve invested in a location; we’ve built the store itself. He just picked on one aspect to prove the whole idea of the thinking of Aldi. Lowest cost, but over the long term...he invited senior executives to his home for dinner, and we were all laughing like crazy when we saw the same bloody floor tile in his house. - Former CEO of Aldi UK

The low cost mentality at Aldi gets into details such as the car park gradient to save trolley costs:

"If you built a new store and the car park gradient was more than 2%, this was an owner that could spot it before he drove onto the car park. He would claim, if the customer lets go of their trolley, while they are trying to fill their car up, the trolley will roll away... All of that means that you will lose trolleys, they will get rusty, they won't have the same life length and you will need labor to collect the trolleys. - Former CEO of Aldi UK

Culture is exemplified in certain difficult decisions made by leaders:

One thing that's a no-go, that Jim talked about frequently, is the Calvin Klein jeans. The buyer brought Calvin Klein jeans in, of great value to the marketplace and was able to get the price down to say $29.99 and $24.99 then $19.99. He talked about the temptation of the buyer to keep part of that back and inflate their margin because there was such large price depreciation from great negotiations. But there was a margin cap that Costco always had, which was 14%, and if the buyer had kept some of that back and inflated their margin, which would have helped them make numbers, which would have had great pay outs for bonuses, and even the department overall then – in Jim's words – that would have caused an environment where the buyer would have been terminated. But Costco continued to take just the 14% gross margin and take their price down with every subsequent cost decrease. That is honoring exactly the commitment to the membership who's paying to shop with Costco. - Former Senior Manager at Costco

Carvana and Amazon

Amazon and Carvana are two e-commerce low cost operators we follow closely. Both companies are designed to offer the lowest cost to customers.

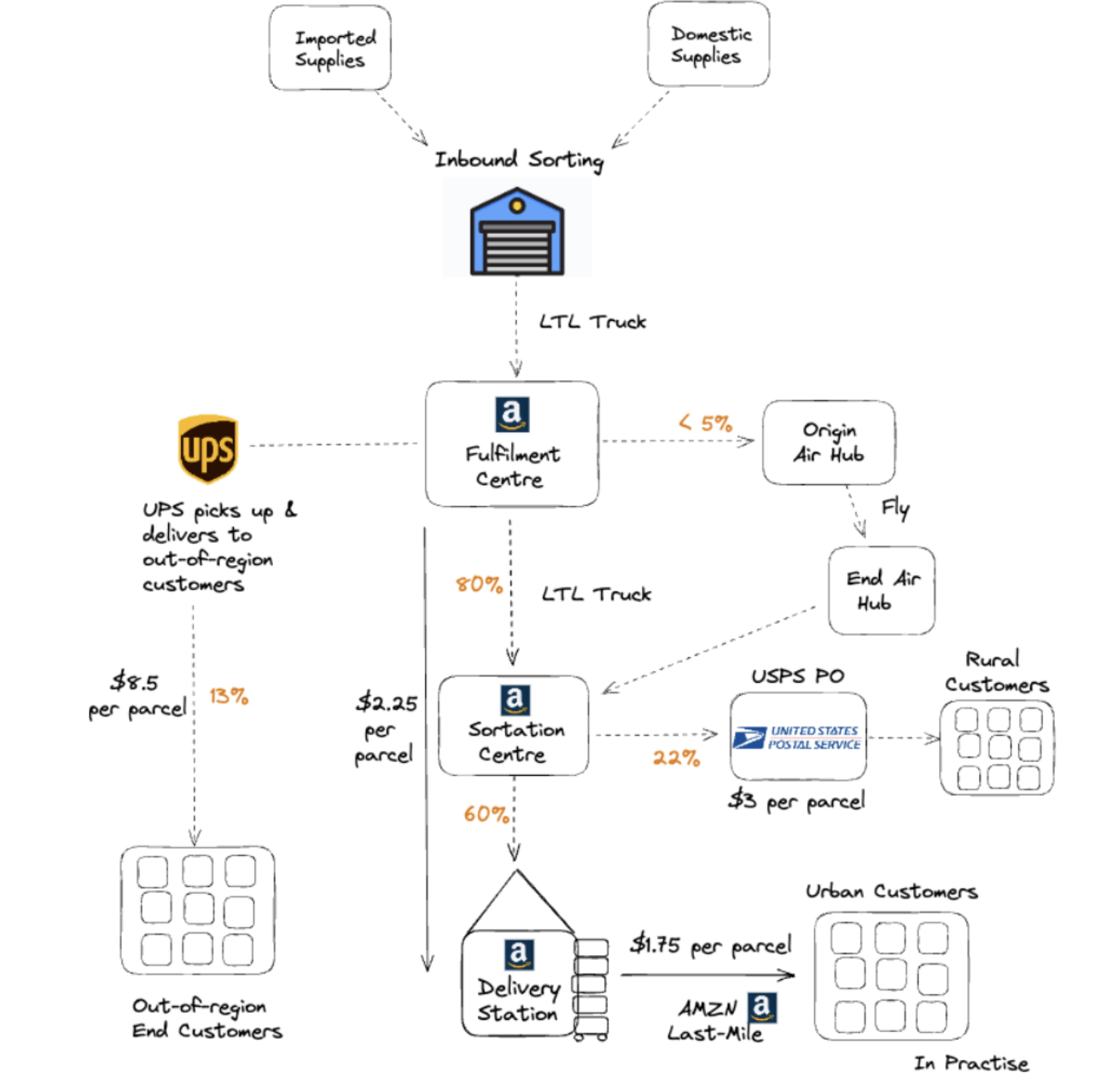

In a few years post-COVID, Amazon effectively built a last-mile network to similar size as Fedex. This aims to ship products faster and cheaper. In 2023, over 60% of parcels were shipped through AMZN last mile network at a cost per parcel of $1.75, nearly half the USPS rate.

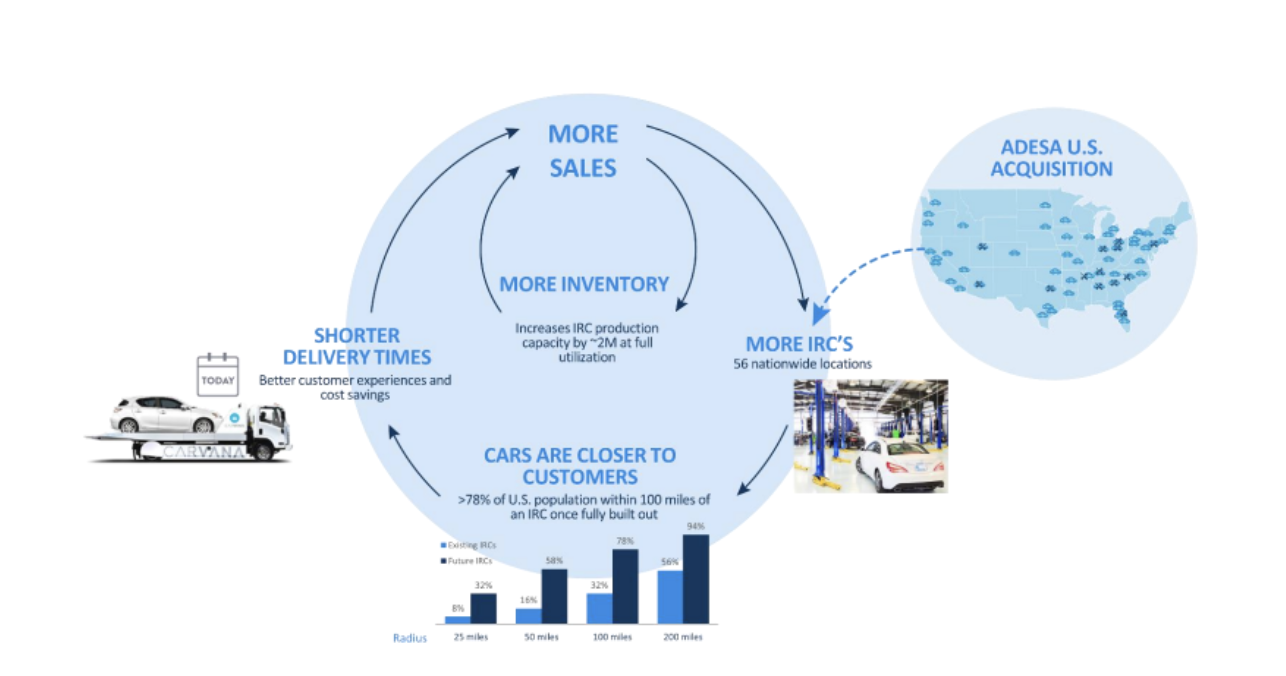

Carvana has built its own version of Amazon’s retail infrastructure by repurposing ADESA’s wholesale auction real estate to inspect and recondition used cars at scale. With ADESA, Carvana now has an IRC within 100 miles of ~78% of the US population. This reduces shipping time and cost for last-mile delivery and enables same or next day delivery possible for many customers.

"I believe the main reason ADESA was attractive to them was access to markets. By acquiring the real estate that ADESA owned across the entire US, which I believe is 54 locations at this time, they gained proximity to what they believed was 90% of their potential customer base. This real estate can be utilized in several ways. For instance, it can serve as a last-mile location... This is where the ADESA locations come in. They can handle the final step, which might involve light work on the car, similar to what a dealership would do. They wash the car, fuel it up, and ensure it's ready for delivery, so the customer receives it in perfect condition. - Former Senior Manager at ADESA

"Today, they have an incredible logistics operation, allowing them to move a car across the country much cheaper than anyone else." -- Former Associate Director of Engineering at Carvana

An IRC is typically three to seven days faster in processing vehicles [vs local dealerships]." -- Former Associate Director of Inspection Centers at Carvana

CarMax mainly uses 3P logistics providers for inter-store transfers within states and last-mile delivery. This increases the cost relative to Carvana shipping vehicles on its own single and 9-car haulers.

generally speaking, if it costs you $400 per unit to move your cars with a third party, it's likely half that, if not less, to handle it internally." -- Former Associate Director of Inspection Centers at Carvana

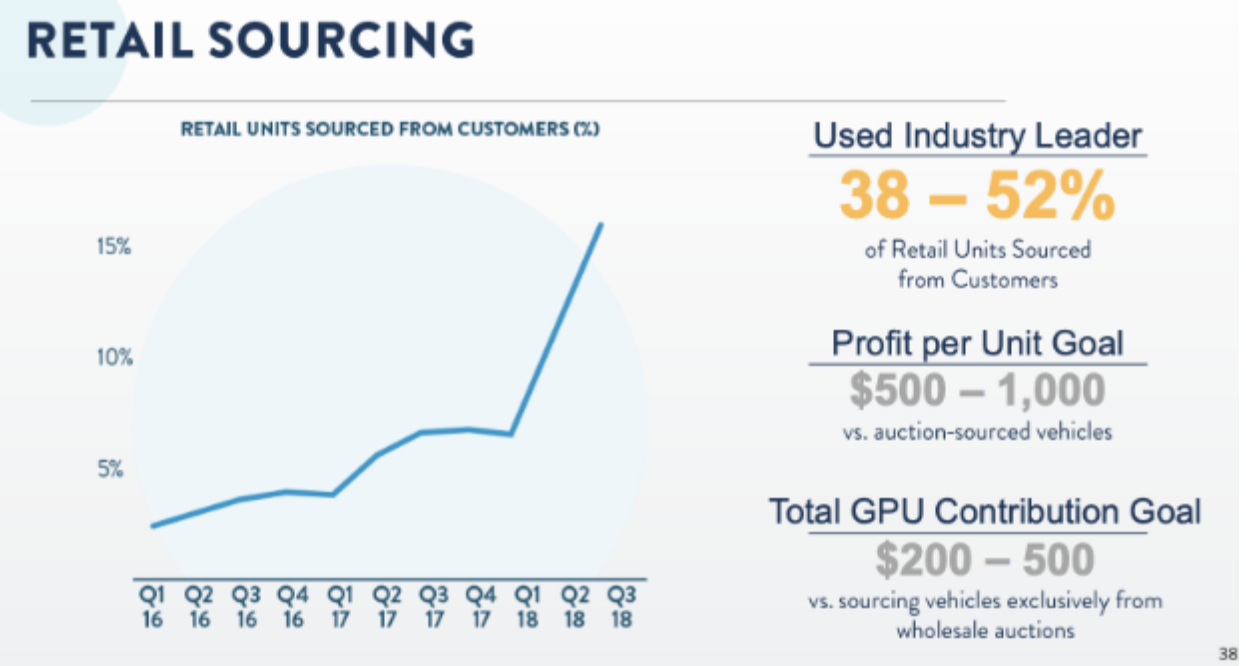

Over 80% of cars sold by Carvana are sourced from customers. This is double CarMax’s rate.

Our customer sourcing ratio is basically the percent of retail units sold that were sourced from customers versus be in the wholesale market. is about 83% so far this year. That's up 10 points from 2021. We think that this kind of mid-80s -- low to mid-80s range is around the upper end of our target range. - Carvana CFO, 2023

Carvana also believes it can earn $500-1,000 higher GPU per customer sourced vehicle compared to purchasing vehicles via wholesale auction.

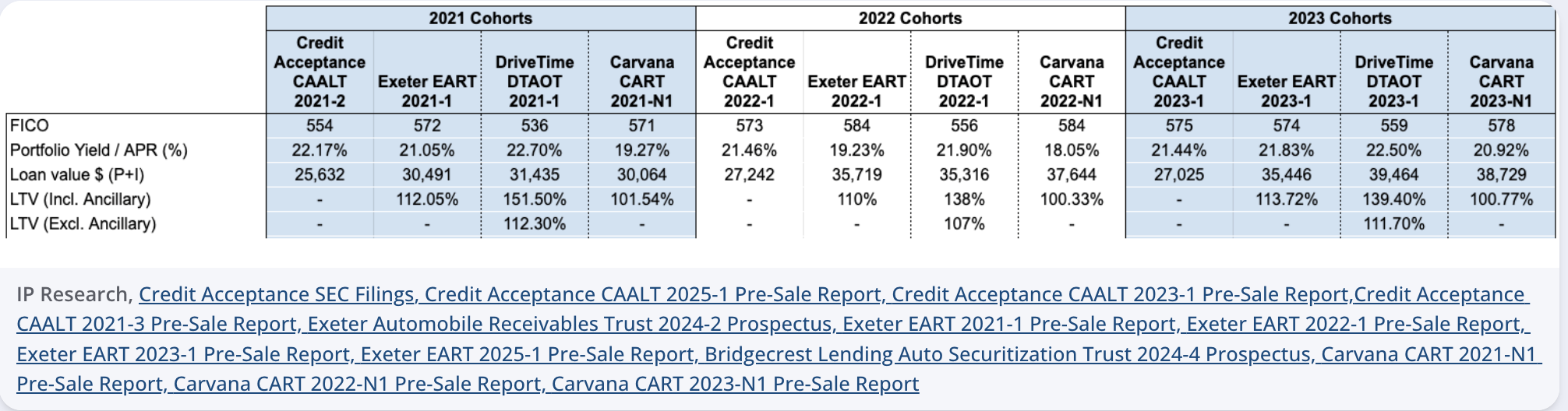

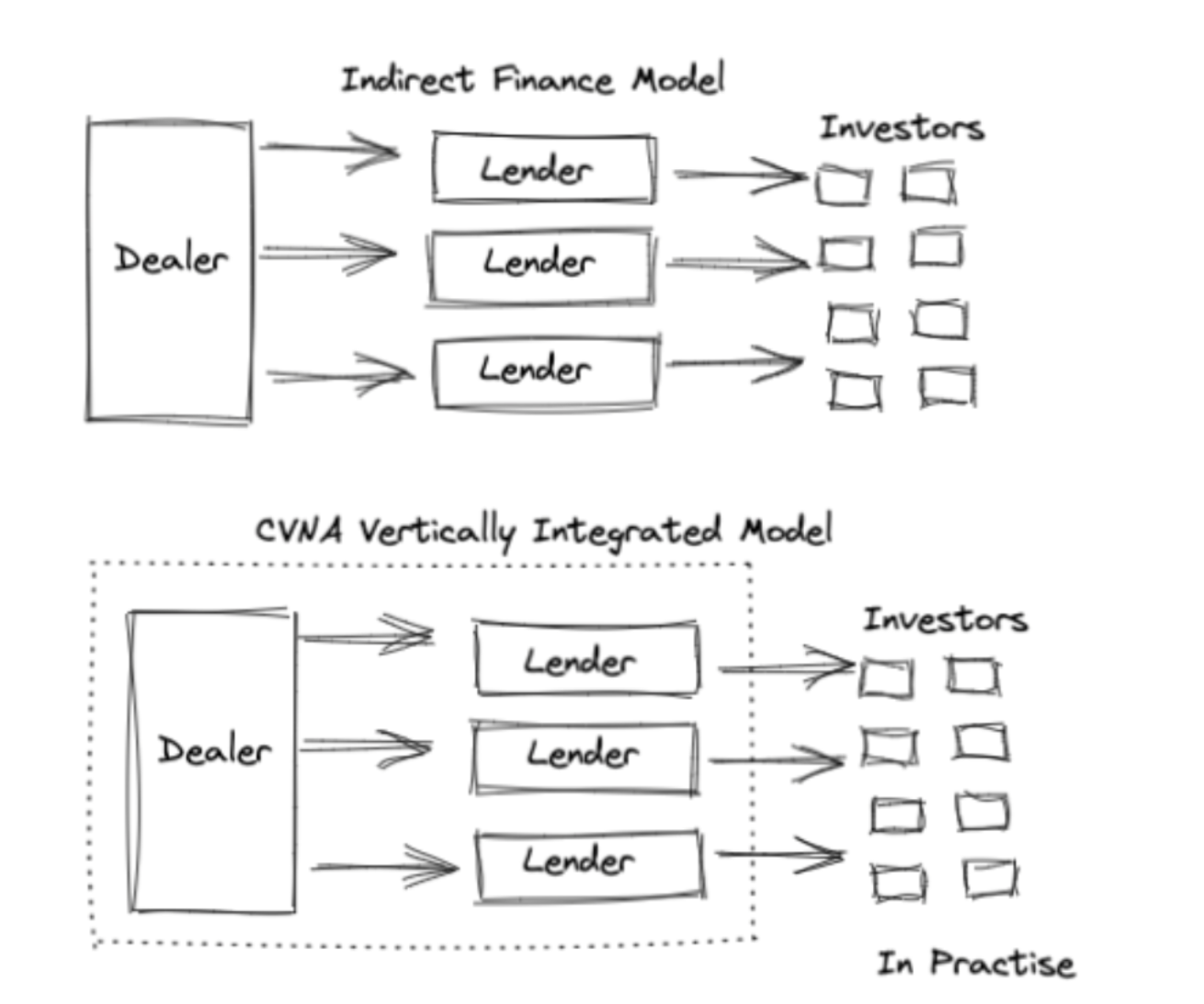

Carvana has also vertically integrated its financing offering. Around 80% of vehicles sold on Carvana are financed by the company. Carvana acts as the auto dealer that buys and sells the vehicle and the lender that originates the loan. These loans are then securitised and sold to ABS investors.

This loan origination model combined with vertically integrating reconditioning and delivery enables Carvana to offer lower costs to customers. Lower vehicle procurement and processing costs and lower retail prices lead to lower LTVs and lower net cumulative losses relative to competitors.

When you think about performance, you need to consider the additional premium that a customer is paying from a monthly payment perspective because that's an APR added on top of your risk-based pricing…the difference between indirect to direct would be that the same customer pays a slight premium on the loan. This translates into a higher risk for a customer from a net charge-off perspective or performance because they are paying a premium for the same car. - Current Chief Risk Officer at US Auto Sales & Former Director at Santander Consumer

Just as Carvana extended its low cost mentality into its financing business, Amazon Retail’s low cost mentality extends to AWS. The company has built Graviton CPU and a custom ASIC in Trainium to vertically integrate down the cloud stack to save cost for customers:

The second thing to consider is memory bandwidth, which is the speed at which data transfers between memory and the core. AWS is closing that gap, reaching 2.3 to 2.4 terabytes per second, and they are increasing in the next generation. I think TPU is at a similar level. From a technical specification point of view, they are getting closer. In terms of functionality, it comes down to experience and AWS's execution capabilities. I'm biased because AWS faced a similar issue with Graviton CPUs. Graviton, from the same family as Trainium and Inferentia from Annapurna Labs, focused on ARM-based workloads. They successfully migrated many customers from Intel and AMD to Graviton, achieving 30% to 40% cost efficiency. I believe the same sales strategy will apply when moving customers from Nvidia and AMD GPUs to Trainium hardware. However, this is not a one or two-year game; it's long-term. TPU will continue to innovate, and AWS will do the same. From a hardware perspective, they are close, not quite there yet, but very close. Every step moves them closer. I see a promising future for Trainium. I had my doubts six months ago, but after recent news and listening to Andy Jassy on that call, I'm confident that Trainium is the Trojan horse for AWS. - Former Generative AI Director at Amazon Web Services

Ryanair

Ryanair is an example of a business model designed with low-cost in its DNA. A focus on cost permeates every strategic decision. Ryanair owns nearly all of its aircraft when the market leases most of its planes.

Ryanair is fantastic. They have around 80% unencumbered assets that they own. During the winter, they essentially park the aircraft and don't use them, so their costs are minimized." - Former Executive at Wizz Air

Ryanair operates in second-tier, less slot-constrained airports. It prefers Stansted over Heathrow London, for example. Ryanair has bargaining power to reduce landing charges in smaller airports:

In smaller airports, where they're completely reliant on one carrier like Ryanair, bringing them 500,000 to one million passengers a year, sometimes they offer free landing charges for a period of time. Airports may also offer marketing funds.- Former Senior Manager at easyJet

Less slot-constrained airports enable a more flexible airline schedule and prevent delays if the aircraft misses a slot. This maintains higher than average aircraft utilization which enables lower air fares:

Unlike Ryanair, which operates in about 30% slot-constrained airports...about 70% of the airports EasyJet flies to across the UK and Europe are non-slot constrained. This allows them to control their schedule, avoid ground movement delays, and adapt quickly without slot-related costs.- Former Senior Manager at easyJet

If an airline misses a slot in tier 1 airports, the aircraft may remain grounded which decreases utilisation and increases costs:

You also have a team that looks at slots. Making a business case is one thing, but it's different if the flight arrives in the morning versus at night, depending on the destination...For instance, if the aircraft also flies to London, they have a specific slot and cannot change it to land four hours later if it's unavailable. - Former Revenue & Capacity Management Executive at Wizz Air

A more effective routing operation attracts pilots who wish to take-off and land in their home country. This drives higher pilot hours, higher utilization, lower costs, and happier pilots:

I've spoken to many pilots who say it's great. They wake up and land at home the same day, have regular schedules, and know their flights a month in advance. It's a very organized operation." - Former Route Development Manager at Ryanair

Ryanair also owns pilot schools and is moving into maintenance to save further costs:

"What Ryanair is doing...is keeping their costs down by buying aircraft, so they own them. They don't pay leases. The volume and mix of owned versus leased aircraft is really impressive. Ryanair is investing in its own fleet. They have their own crew schools and pilot training centers. They are building maintenance centers all over Europe, so they don't need third parties for maintenance. They're looking into long-term maintenance centers for big overhauls that could take up to a year." - Former Route Development Manager at Ryanair

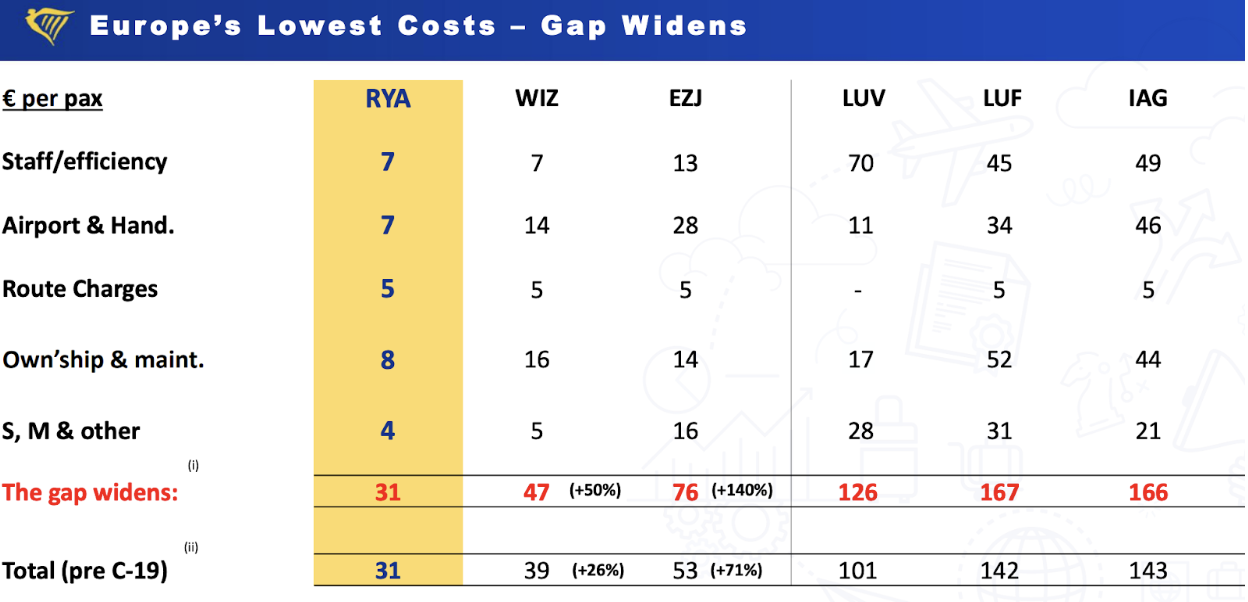

This leads to lower cost per available seatmile vs competitors:

Wise

Wise is a relatively new addition to low-cost operators we admire. It’s a win-win-win model that seems to epitomise durable low cost cultures:

“If Itaú runs on SWIFT and their standard BRL to USD payment carries an internal cost of, let's say, on average $5—I'm exaggerating this massively on the lower side, but let's just say it's $5. Wise comes along and says they can do it at a net cost of zero to you. In fact, they give you revenue back. Which one would you choose? This comes with first principle margins—where is your cost, what is your revenue? Essentially, it's a game theory construct where everyone benefits. The prisoner's dilemma is resolved, right? The equilibrium condition is that the customer is happy, pays lower fees, and receives faster service. The bank is happy because they don't need to pay for servicing, and it's easier to integrate. Wise is happy because they're gaining market share. Tell me what's wrong with this. It becomes a no-brainer decision. For TransferWise, this scale allows us to strategically reduce charges for our customers as we grow. We pass the benefits of additional volume back to our customers. This aligns well because without Nubank integration, we have half a million users, but with integration, we have 1.4 million potential users. We see value in serving more people, and even if we charge them 20% less, we'd still be 60% better off. - Former Director at Wise

The business model seems to have economies of scale built over years of scaling its own payments infrastructure:

What they [Wise] realized was that if they enter various markets to serve customers locally and win business, they establish company infrastructure, obtain licenses, and hold cash in those markets. They didn't need the money to flow through a centralized treasury function before releasing the payment. For example, if they have a customer in London receiving money from the U.S. and needing to make a payment to Australia, they have complete visibility of the money coming in and going out on their proprietary network. Because they now hold a float of currencies in these markets, they can initiate the payment in Australia as soon as they receive the U.S. dollars, without waiting for it to go through the system. They release the payment the moment the sold currency is in their domain. They still run the same sequential settlement process, but they have 48 hours' worth of payment float in currency inventory on their balance sheet in-country. Currencycloud shied away from this in the early days. Yes, this would increase working capital. It affects the cost of their treasury. As you might imagine, this dramatically expedites the payment process, making it much quicker. Which means you can win more customers, process more transactions, and make more money. However, as you process more transactions, the balance sheet requirements to hold currency in-country increase significantly. So it becomes a very capital-intensive way of doing that. You then have to redouble your efforts to sell to customers in markets that are moving currency in the opposite direction. For every Australian dollar going out, you need Australian dollars coming in to go in a different direction. You have to create your own market in all the different areas. It's doable, but it takes some managing. Another thing we looked at and puzzled over was the balance sheet foreign exchange risk. As we mentioned earlier, payment flows are asymmetric and will always be so, no matter your best efforts to win customers going in the other direction. You'll always have a foreign exchange exposure in one direction, which needs managing. TransferWise has accounts in sterling, but they have multi-currency inventories worldwide that constantly fluctuate in value relative to their accounting currency. There are ways to manage that with a sophisticated treasury function, but it requires effort. It's only worth investing in the infrastructure and skills to do that once you have suitable volumes to justify it, which they obviously have now. This has enabled them to move very quickly and dramatically reduce payment times. They can often achieve near real-time settlement in these T2 currencies we discussed earlier, which is a significant competitive advantage for them. - Currencycloud Co-Founder

It’s always a good sign when even employees of the competitor uses the product:

“Their value proposition is no SWIFT middlemen, lower fees, better transparency, improved FX rates, and faster service. Ironically, when we worked at SWIFT, we all used Wise. - Former Market Infrastructure Executive at SWIFT

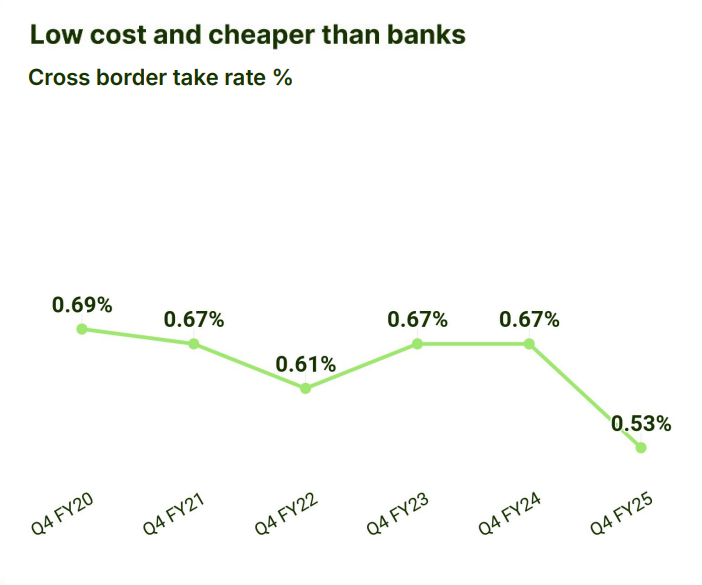

Wise continues to reduce its cross-border rate while traditional banks charge 3-5%; the longer the route the higher the take rate. In true low-cost mentality, Wise drives profitability through volume vs price increases.

Wise focuses on becoming more efficient so that their net profit margin, or the profits they generate per transaction, increases. Unlike banks that hike up prices to make more income, Wise aims to achieve a certain margin. If their costs reduce due to efficiency and scalable operations, they maintain their margin. For Wise, it's a volume game, and I want to emphasize that. - Current Payments Director at Raiffeisen Bank International

Leadership continuity

One final observation for each of these businesses is the continuity of leadership. Each of these companies has long-tenured leadership and a culture of promoting from within.

- Costco - Sinegal was founder and CEO from 1983-2011. Jelinek joined Fedmart in 80s and was Costco CEO from 2011-23.

- Amazon - Bezos hires from within; current and Former Amazon Retail CEOs Doug Herrington, Dave Clarke, and Jeff Wilke all had or have over 20 years experience at Amazon

- Carvana - (father) and son founder-led 13 years later

- Wise - founder-led 15 years later

- Ryanair - O’Leary has been at Ryanair since 1988…

Ryanair, however, has had the same leadership for over 25 years. They have maintained their cooperative, cost-disciplined structure, focusing on keeping unit costs down and revenue up...EasyJet has had different leadership every five to seven years, bringing new ideas and changes. - Former Senior Manager at easyJet and Flight Operations Manager at Ryanair

© 2024 In Practise. All rights reserved. This material is for informational purposes only and should not be considered as investment advice.