Constellation Software: Incentive Structure & Organic Growth

The common pushback against a Constellation Software long thesis is threefold:

- AI disrupts software

- They can’t continue to deploy FCF into M&A

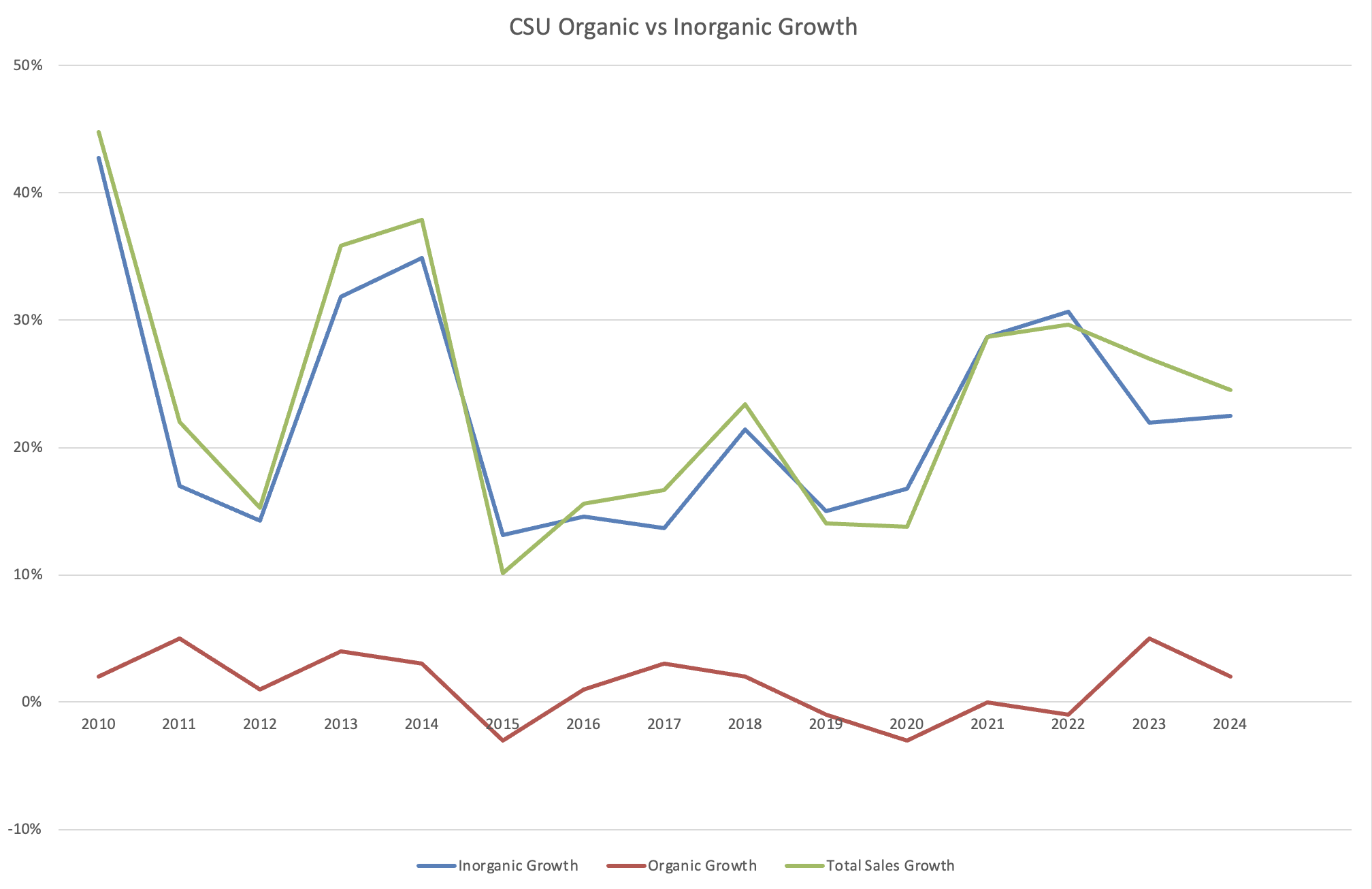

- And when the M&A machine stops, this is a mature, slow-growing (read: dying) software business with 1-2% organic growth. This doesn’t deserve a premium multiple.

Putting aside the AI risk, which we explore in multiple interviews, we've been exploring questions two and three. More specifically: if the M&A machine significantly slows, does CSI have the expertise internally to drive organic growth?

From 2010-24, organic revenue growth was ~1.5% per year. Adjusting for inflation and the Year-1 post-acquisition jump from re-pricing and cutting cost, the stable organic growth for the core portfolio is arguably negative YoY.

Why is organic revenue growth so low?

One answer is that CSI buys mature, slow growing companies; ‘the graveyard of software’. But there is also a more subtle reason: the company’s compensation structure.

Constellation’s annual bonus structure is derived from multiplying three components: a corporate factor, a personal factor, and the annual salary.

Free Sample of 50+ Interviews

Sign up to test our content quality with a free sample of 50+ interviews.

Related Content

Roper Technologies: Leadership, AI Strategy Execution Challenges & Customer Retention Risks

Former VP at Roper Technologies

Constellation Software: Public Sector Churn & Switching Costs

Former Portfolio Manager, Trapeze US

Constellation Software, Trapeze & Private vs Public Customer Switching Costs

Former Director, Trapeze at Constellation Software

Topicus: Dutch Primary Education and AI Risks & Opportunities

Former Managing Director at Topicus

© 2024 In Practise. All rights reserved. This material is for informational purposes only and should not be considered as investment advice.