H1 2025 - Most Viewed Interviews & IP Research

Top Articles in H1 25

This IP Research piece was the most read article in H1 25 and is a curation of 3 months of research on proprietary and broker-led M&A sourcing strategies at Constellation Software vs Vitec. One particular quote from our March Stockholm sparked this research piece:

We hardly ever see Constellation or Topicus in the same deals as us - CEO of Vitec, March 2025

How can Vitec, a Nordic VMS acquirer, ‘hardly ever’ see any Constellation operating group when acquiring VMS assets across Europe?

One simple explanation is that the companies have different targets: Vitec typically buys higher-growth SaaS companies for ~10x+ EBIT whereas CSU typically buys on-premise, slower-growing assets for 4-6x EBIT.

But potentially a more subtle reason is that Vitec sources 80% of deals via brokers whereas Constellation sources ~70% outside broker channels.

What most people need to understand is Constellation is seeing a lot of these opportunities before anyone else gets a look. Generally speaking, it's one-to-one; they're not shopping the business. I would say about 65% to 70% [of deals are proprietary]. - Former M&A Director at Constellation Software

This line of questioning led us to explore exactly how Constellation sources proprietary deals and how this may define part of Constellation's moat as competition increases. We also study the company manages its CRM which is most likely the largest software company dataset on the planet.

What most people need to understand is Constellation is seeing a lot of these opportunities before anyone else gets a look…This is the greatest thing about Constellation. They have a Salesforce database of around 60,000, 65,000, 70,000 or however many software companies. Basically, every software company in the world is included…this is all in Salesforce, which I have access to from day one at Constellation. - Former M&A Director at Constellation Software

This research can be read alongside various other interviews on the subject:

This interview with a Claims Manager at Progressive, responsible for choosing between Copart and IAA, shares the decision making process when choosing a salvage partner and why Progressive is shifting volume to IAA:

Over the years, our volume has been anywhere between 75% to 82% with IAA. We have shifted some business, and over the last several years, it's gone from 18% to closer to 20% or 21% with Copart. We don't want to go too far in one direction, and while 80/20 is significant, we aim to maintain at least 20% with Copart. We're totaling close to a million vehicles a year, so 20% is still 200,000 vehicles going to Copart. As we've grown, the net volume has always increased, so Copart is happy because we continue to send them more business net-wise…the reason Copart isn't getting more business isn't due to what they're doing or not doing, but rather what IAA is doing. That's an easy way to explain it. - Current Claims Manager at Progressive

Given IAA potentially taking share and Copart’s 20% drawdown YTD, this work could prove quite timely:

This interview with a Former VP of Sales at Aldevron explores the history and mechanics of manufacturing DNA plasmids and how Danaher and Thermo are positioned:

For DNA, it's a bit different and fragmented. I would say it's GenScript, VGXI, Eurogentec in Europe, and Cobra, which is now Charles River. There are so many different ones now. It's all about phase dependency. The big thing for early phase now, even with AAV, is GMP-type plasmid. The big players there include some smaller shops that have been in the plasmid business for a while. For mRNA, you have the bigger companies getting into it and sourcing plasmid from those I mentioned, as well as Aldevron. It's interesting because Thermo announces GMP plasmid capabilities, and so do others like Breakthrough Medicines and TriLink. They announce it and then ask us, Aldevron, to be their exclusive source. It's ironic; they announce themselves as competitors and then want us to supply them. But at the end of the day, money is money, so it works out. - Former VP at Aldevron

This interview follows our historic work in bioprocessing which focused on Cytiva and downstream equipment and reagents:

- Danaher Biotechnology: Cytiva & Downstream Bioprocessing curates all our historic work on downstream bioprocessing and covers the following:

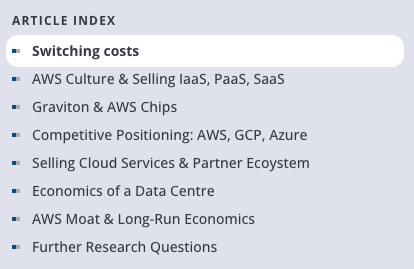

This interview with a Former Capacity Planning Director at AWS explores how AWS builds out data center capacity relative to competitors and the respective economics across regions:

AWS pricing is influenced by economies of scale. Land, power, and other factors contribute to costs. Larger regions generally have lower costs due to economies of scale, and AWS passes these cost reductions to customers as regions grow. When customers want to move to the cloud, they decide where to place their region. Latency is a factor, but price is usually the main consideration since latency differences, like between Ohio and Virginia, are minimal—maybe one or two milliseconds. - Former VP at Amazon

AWS follows a different strategy when building capacity compared to Google and Microsoft:

I can elaborate on how they plan capacity, but it doesn't change from a capacity perspective. One important aspect to understand about the industry is that the architecture of these companies differs. When AWS started, they introduced the concept of three availability zones. For every new region they launch, they create three distinct data centers, geographically separated by many kilometers for redundancy. It's not just two. Typically, people assume there's one data center and a second one for redundancy, copying 100% of the volume to the other nearby. There are technical specifications on how far apart they can be, roughly 10 kilometers. They're not in the same location because the idea is risk mitigation. This differs from competitors like Microsoft and Google, who often have redundancy on the same site. They replicate on the same site. AWS argues that their solution is more secure. They claim it's cheaper to have a 33% copy across each of those availability zones than 100% in two. - Former VP at Amazon

This interview can be read alongside our prior work on AWS:

- Kubernetes & The Portability Illusion explores Kubernetes and the risk of porting workloads between clouds

- AWS: Running a Hyperscale Data Center with a Former Director at Amazon Web Services

- AWS Graviton’s Process Power covers Amazon’s hardware-software integration as a competitive advantage

- Amazon Web Services curates all our work historically on the business covering:

This interview with a Former Executive at ASML, who spent nearly 20 years at the company, explores the relationship dynamics between the company and TSMC.

TSMC are much more dedicated. I've visited those three companies many times over the years, and you will always see TSMC in a 60-hour week mode of work. They work day and night, extremely ambitious, with a lot of pressure. This was instilled by Morris Chang, the founder of TSMC. He invented the company philosophy of doing everything possible for the customer's needs, as best as they can. They have been in a fighting mode for 20 years already. In the case of Intel, that's not the case. Intel has been in a very pleasant, typical situation, like Nokia, in a more relaxed, slow-paced, less aggressive mode. Interestingly, Samsung was similar to TSMC. They tried to copy them, but they are less innovative. The mentality of the Koreans is more like an army; they follow the leader. But if the leader fails, the army fails. Whereas TSMC is less Chinese and more American, if I may say. It's a good combination. They have a Middle Western style with a very strong work mentality, and when you put it under the right umbrella with the right organization, they are organized in separate factories, each competing against each other, extremely well-operating. That's why ASML and TSMC like each other so much; they resemble this last-mile mentality. Always going for the last mile, and that's something I've never seen outside of TSMC. - Former Director at ASML

Other interviews on the topic:

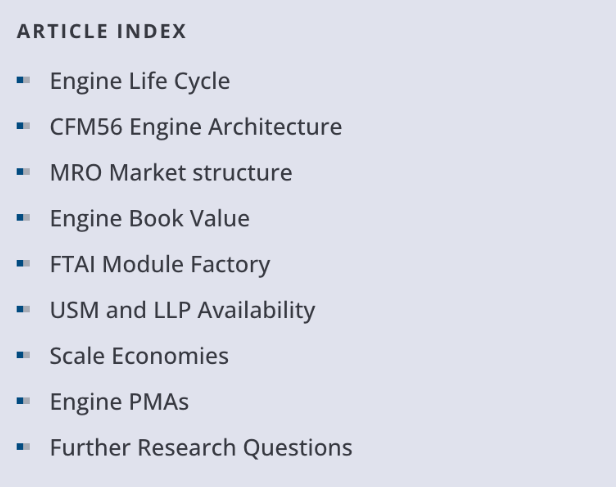

This interview with a Former Engineering Director at FTAI explores the short report on the company as it transitions from a leasing business to an engine MRO shop for mid-life engines. We also spent the last quarter of 2024 aiming to understand FTAIs module swap offering for CFM56 engines, the potential competitive advantage of owning ~400 56s, and why and how the company claims to earn supernormal MRO profits:

- FTAI Aviation curates all our research on the company covering the following topics:

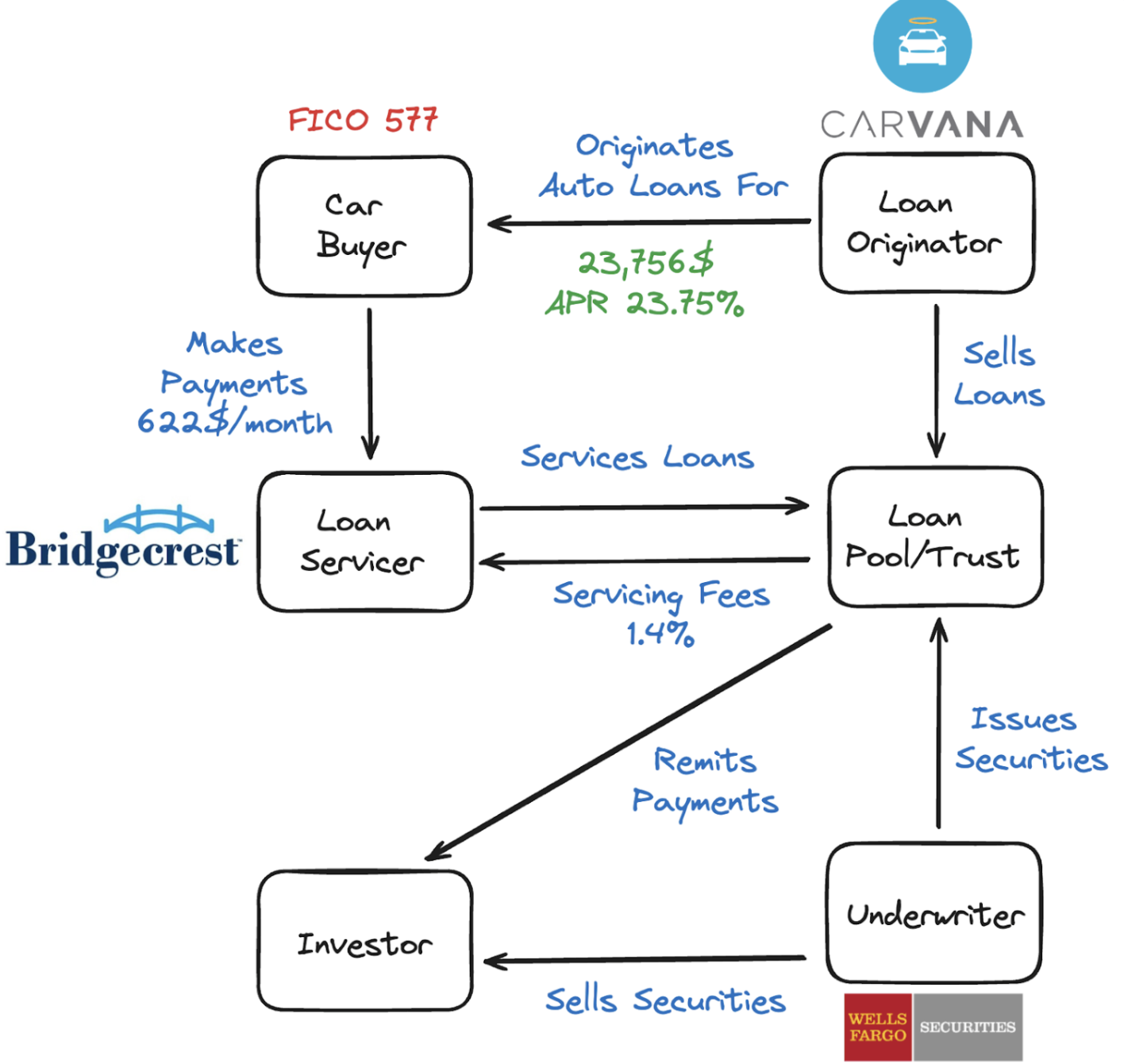

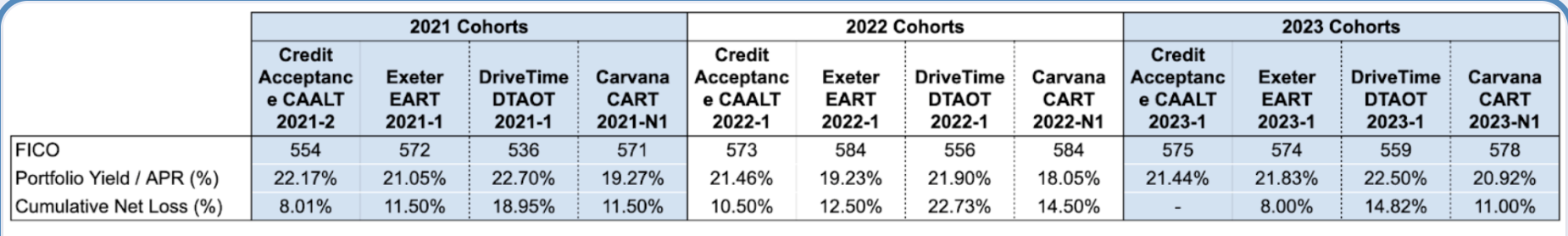

This IP Research article explores the relationship between Carvana and DriveTime, specifically the relationship with its subprime loan servicing subsidiary Bridgecrest. This is a critical relationship because ~40% of Carvana’s loan book is subprime which is ~2x as profitable as prime loans. The nature of the relationship of a related party involved in such a critical operation has raised questions.

We explore the history of DriveTime, how net cumulative losses compare at Carvana, DriveTime, and competitors, and the trends in Carvana's ABS LTVs and over-collateralisation.

This piece can be read with many historical interviews and research on Carvana’s financing business and subprime lending:

This interview with a Former leader of Amazon’s B2B business explores the history of how the company broke into industrial and healthcare product distribution. Just like in retail, Amazon aims to offer a wider range at lower cost than incumbent B2B distributors:

As a buyer, you don't have much visibility into what you're purchasing. You're not conducting a sourcing event for small dollar purchases or spot buys, which often leads to overpaying. Additionally, the speed of delivery and transparency aren't great either. With a broader marketplace solution like Amazon, you can easily order these SKUs, get competitive pricing, and benefit from Amazon's network, which provides excellent delivery, transparency, and visibility. It's almost like conducting a micro sourcing event for each purchase, with multiple sellers competing for your business. As a procurement leader, there's significant value in that. - Former GM at Amazon

This interview can be read alongside other research on Amazon B2B distribution and the underlying drivers of the retail marketplace:

- Amazon Retail curates all our historical work on the company focused on the following topics:

In 2023, we also attempted to split out COGS and SG&A between Retail and AWS to estimate the underlying earning power of the Retail business:

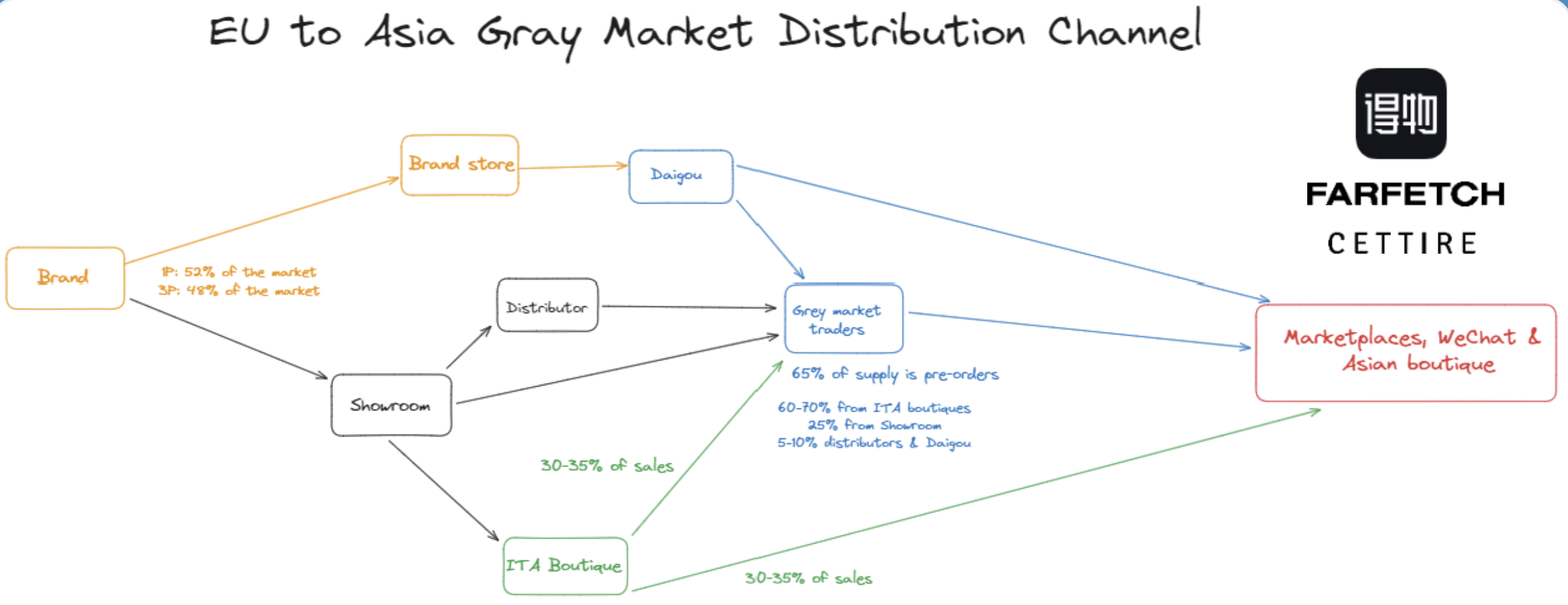

This piece of research curates our learnings of 3-4 months of studying the luxury gray market.

I think it's just a little bit less than the gray market, so around 25% to 30% from the marketplace. -Former Export Manager at Italian Multi-brand boutique

We explore how luxury brands distribute overstock from Italian multi-brand retailers to various channels across Asia including via platforms such as Farfetch and Cettire.

We also explore the impact of Diagous on driving APAC luxury demand:

In this case study from one of my companies, we asked two Daigou individuals where they get their products. The first one said boutiques, and the second one said brand shops and outlets. The first one operates with only two people helping him run between boutiques. His monthly transaction was six to seven million renminbi. (...) they are a Tier 3 operation with only three people, reaching six to seven million renminbi. The profit for this tier is around 18%. - Former BD Executive at Chinese Marketplace

We also have various other recently published luxury interviews and primary research:

This interview with a Former Chief Engineer at GE explores the company’s unique engine technology:

GE doesn't want to give away the HP turbine and compressor technology. One of the reasons for tremendous improvement in performance is GE's knowledge of fan blade design. The GE90 fan blade, for example, which is on the 115B, is in the Smithsonian Library because of its advancements in material. Safran had no major impact or input on that. The technology was developed by GE. The same goes for the compressor. GE's compressor designs have revolutionized the ability to run at much higher pressures and T3s, which is the temperature at the back end of the compressor. The GE90 or the GE9X, which is the next generation to replace the 115B, has T3 temperatures up in the 1,300 to 1,400 degrees Fahrenheit range. These temperatures subsequently play on and are the coolant temperatures for your HP turbine disk. - Former Chief Engineer at GE Aerospace

And why the LPT module in a CFM56 is likely the most swapped module by an MRO shop such as FTAI:

Our goal with the low-pressure turbine (LPT) design is to achieve really long LLP lives. Typically, the requirement was to have three shop visit turns before any LLP maintenance on the LPT is needed. Initially, the high-pressure (HP) turbine disks required replacement after about 15,000 cycles. However, over the years, with usage data and collaboration with the FAA, that number has increased to about 25,000 cycles. This varies with different applications and thrust levels, but that's the average. We designed the LPT to last through three shop visits, meaning it should have three times the LLP of the HP turbine. This allows the LPT to be reused even after the HP turbine has reached its limit and needs replacement, which is costly. The LPT still has a reasonable amount of life left, so it can be bolted on and used until it runs out. The system is designed so most maintenance occurs in the HP turbine, preserving the LPT and other components like the fan module for longer LLP life. - Former Chief Engineer at GE Aerospace

We’ve extensively covered engine OEMs and Howmet as a critical casting supplier:

Related Content

ASML & TSMC: Lithography Tool Ordering Process & Lead Time Management

Former Senior Executive at ASML

IP Management Reference Checks: Carvana, Applovin, TransDigm, Airbnb, Judges Scientific

Amazon DSP: Building Direct Publisher Relationships & SSP Disintermediation

Former VP at Amazon Advertising

ASML: EUV Technology Evolution & China's 2035 Manufacturing Timeline

Former Senior Executive at ASML

© 2024 In Practise. All rights reserved. This material is for informational purposes only and should not be considered as investment advice.