Published Last Week

In March 2025, Restore Robotics, a remanufacturer of Intuitive Surgical’s EndoWrist Monopolar Curved Scissors received the first FDA 510(k) clearance for a X/Xi instrument. After 10 uses of the scissors, a hospital can now send the instrument to Restore Robotics to repair and replenish as new rather than buying a new instrument from Intuitive.

This [Intuitive threatening customers] made it difficult for hospitals to work with us, so we filed an antitrust suit against Intuitive in 2019. We fought until 2023 when they settled with us. The settlement involved us agreeing not to repair the physical robot, and they agreed not to penalize their customers if we remanufactured the robotic instruments, provided we had a 510(k) clearance. - Restore Robotics CEO

Intuitive now acknowledge the presence of remanufacturing and state on their website that they won't void service contracts or cease doing business with customers using remanufacturers:

“Our customers should know that Intuitive will not void its service contract with, cease doing business with, or consider it a breach of contract by a customer in the United States who chooses to purchase remanufactured instruments that have been remanufactured by a third party pursuant to and in compliance with a 510(k) clearance or equivalent granted by the FDA.” - Source: Intuitive Instruments page

Over the last two quarters, we've interviewed ~10 instrument remanufacturers, distributors and former Intuitive Surgical sales executives to understand the potential impact remanufacturing may have on Intuitive's earning power. Instrument remanufacturing is similar to an aerospace PMA or DER, which threatens the pricing power and unit growth of incumbent OEMs. We explore the similarities and differences of a FDA 510(k) clearance and a FAA PMA or DER repair and how both aero OEMs and ISRG can strategically limit the threat of competitors.

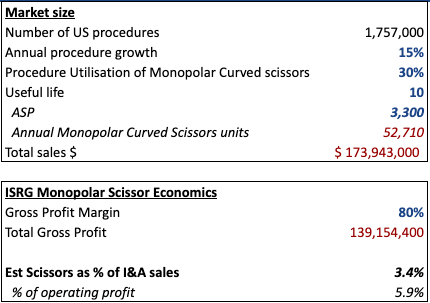

In FY24, Instruments & Accessories contributed ~60% of Intuitive's revenue and and an estimated ~70% of operating income. We walk through the potential threat of ISRG losing market share in monopolar curve scissors, an instrument used in an estimated ~30% of procedures, and how other ISRG consumables may be at risk. While one single instrument isn't material to ISRG, our research suggests remanufacturers are targeting ~40% of Intuitive's Instrument and Accessories revenue.

This research can be read alongside multiple interviews on the company:

This interview with a Former Rolls-Royce executive, who spent over a decade in the Civil Aerospace finance team, explores how engine long-term service agreements (LTSA) are structured and accounted for. TotalCare, Rolls' LTSA program aims to remove the maintenance hassle from an airline. Customers pay a price per flight hour to run the engines and Rolls takes on the maintenance risk.

When selling an engine with a typical 12-year LTSA, Rolls has to forecast two major variables:

- The number of flight hours flown

- Total shop visit costs in Year 5 and 10 including materials, LLPs, and labour

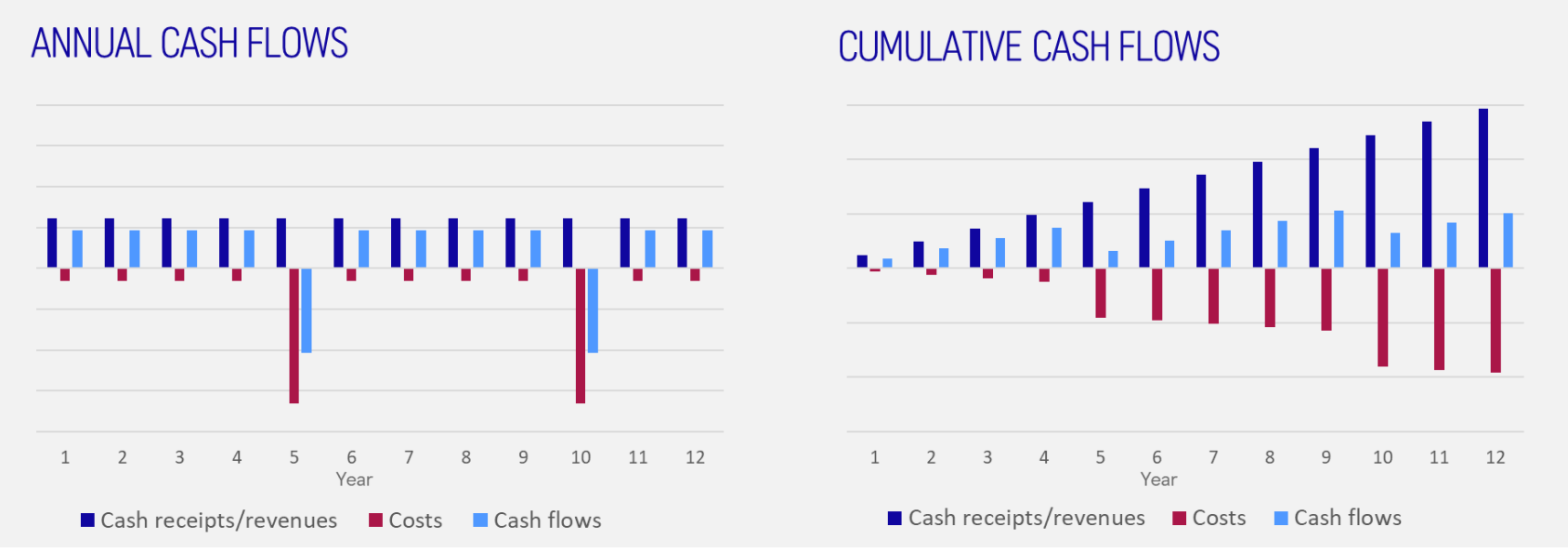

The annual and cumulative cash flows look something like this:

Forecasting such variables over 12 years with accuracy is difficult and slight errors can compound into material earnings adjustments, as we saw with the Trent's issues.

if you were forecasting 500 million and only hit 350 million, it affects profitability. In these LTSA agreements, if profitability was forecast to be 40%, based on reducing costs and hitting 500 million, but you only achieve 350 million, your margin will be lower, and you'll take a hit. It's a nuanced but important point. - Former Rolls-Royce Executive

There are various adjustments to account for forecasting risk:

There are different levels of risk adjustment, for lack of a better phrase. There are three major ones. I think you might hear it referred to as VETs. So it's valuation allowance, estimation risk and technical risk. Valuation allowance is usually related to some kind of specific known risk which probably relates to that particular airline, that particular program. Estimation risk used to be a more generalized percentage applied for that, almost like a cost variance. And technical risk was if there were specific technical issues then you'd have something in there for that as well. - Former Rolls-Royce Executive

The interview goes on to explore the challenges forecasting revenue per hour and shop visit costs in more detail and can be read alongside the following interviews on aero engines:

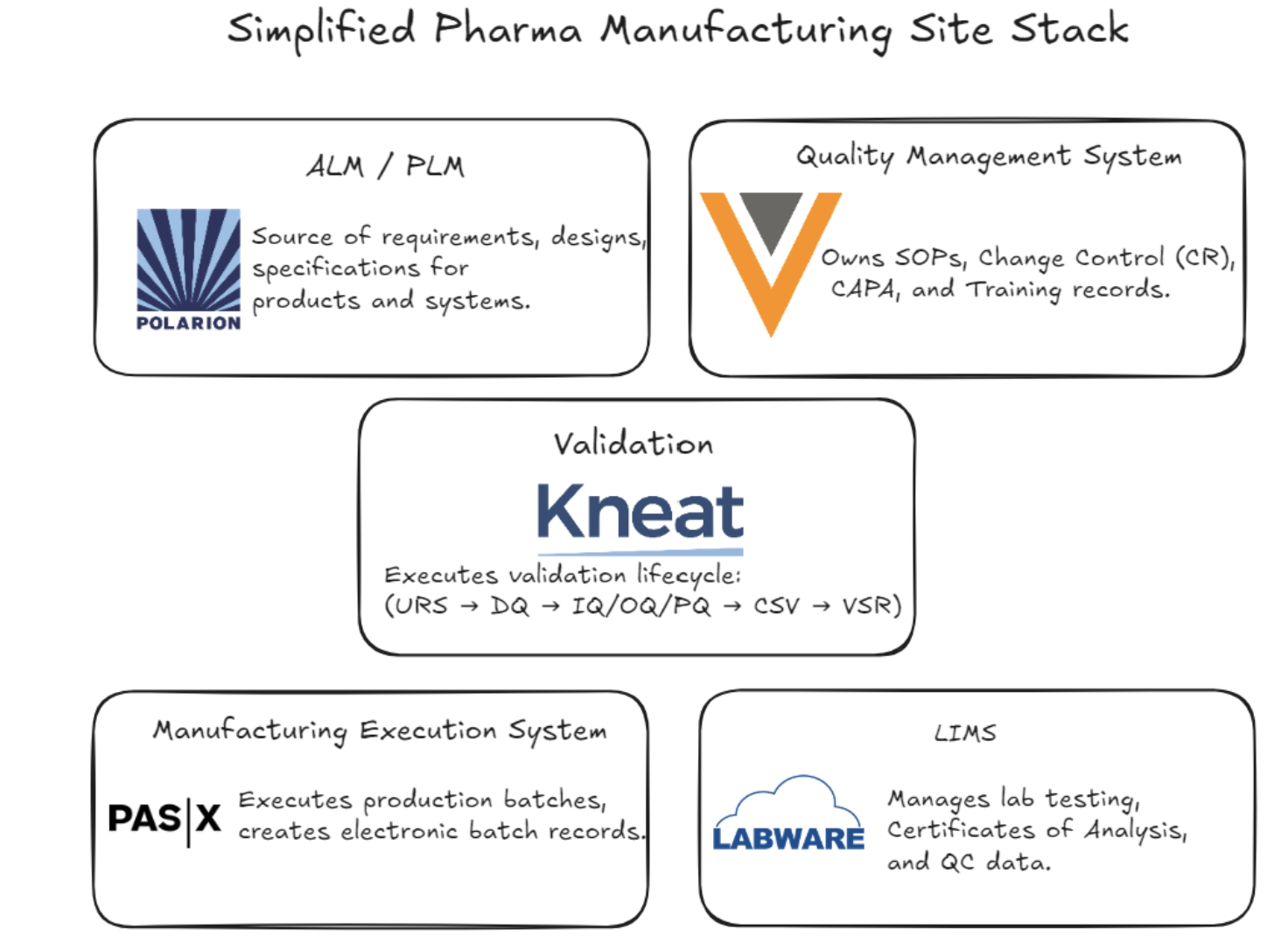

Kneat is an Irish software company listed in Canada with a CAD $600m market cap. The company has grown ARR over 40% per year over the past 5 years with current NRR of over 130%. The company is cash flow break even and seems to have a dominant position in a vertical software market.

Kneat’s SaaS platform, Kneat Gx, helps life sciences companies digitize their validation lifecycle management workflows. This research piece walks through the company’s offering, its stickiness, competing with Veeva, and where it fits in the pharma customer's tech stack.

This work is the culmination of various interviews on the company:

Related Content

GKN Aerospace: RRSP Economics, GTF Cash Flow & Path to £600m

Former Chief Financial Officer at GKN Aerospace

FTAI Aviation: Aeroderivative Gas Turbine Competition

Director of Business Development at Toshiba Energy Systems

FTAI Aviation: CFM56 Aeroderivative Engine Services

Former Aero Services Director at GE Vernova

Airbus A320: SOFITEC Panel Issues & 2025-2027 Production Impact

Former Director at Airbus

© 2024 In Practise. All rights reserved. This material is for informational purposes only and should not be considered as investment advice.