Fever-tree US Off-Premise, AWS, Aercap, GEICO, Judges Scientific, Ryanair

Published Last Week

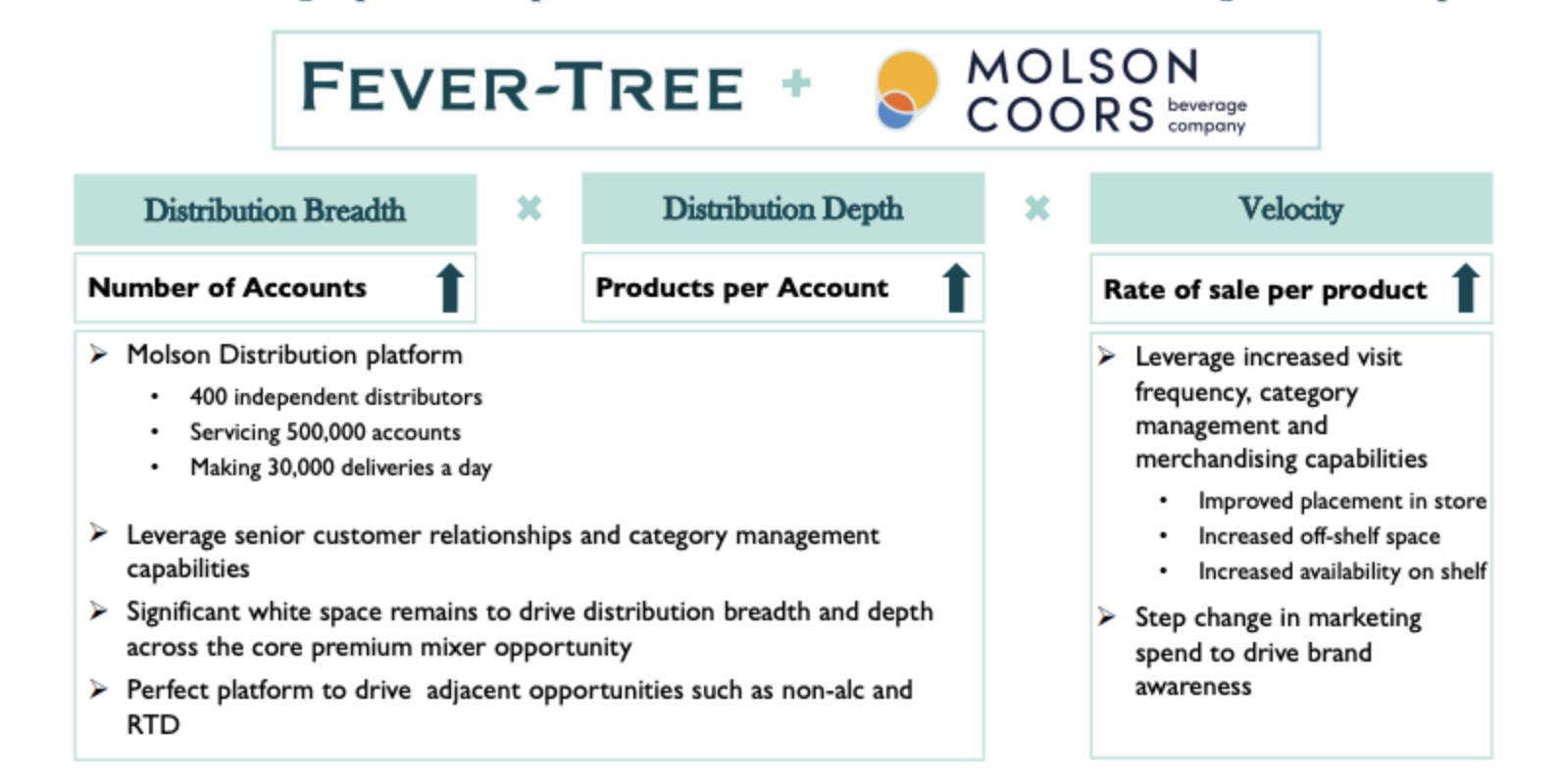

In Q1 25, Fever-Tree signed a partnership with Molson Coors to distribute, market, and merchandise its brand across the US. Molson is responsible for financing Fever-tree’s US working capital and marketing spend. A joint advisory team manages the brand and product development. Fever-tree maintains IP ownership and receives a profit-share royalty which is guaranteed between 2026-30. Molson also acquired ~8% of Fever-tree shares outstanding as part of the deal.

Before the partnership, Fever-tree was selling to ~70k off and on-premise accounts combined across the US. Molson sells to ~500,000 accounts.

Our research focused on a simple question: if Molson is in ~500,000 accounts compared to 67,000 for Fever-tree, where is the greatest opportunity for distribution gains?

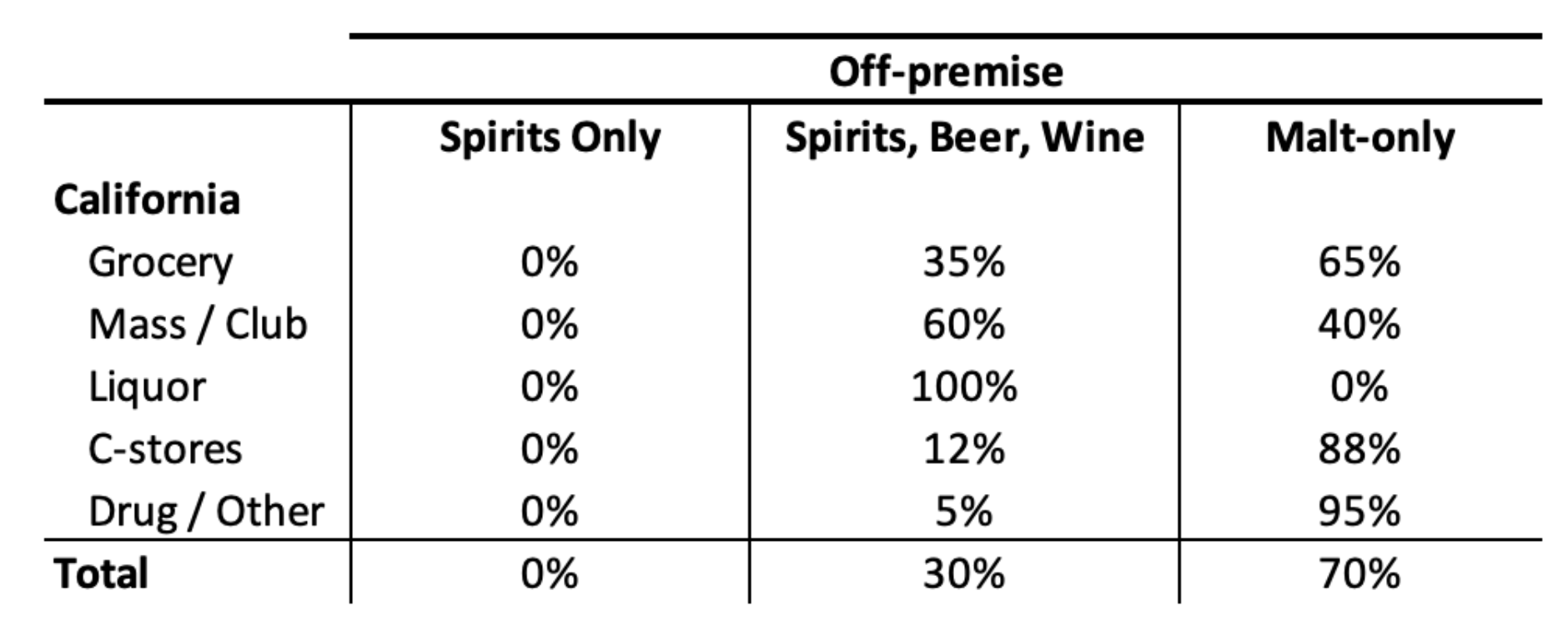

While each state is different, the mix of liquor licenses across account types provides insight into the differences in the distribution network of Southern Glazer's, Fever-tree's old US distributor, and Molson Coors. For example, we explore the mix of malt and spirit licenses in California. This highlights the difficulty of distributing via spirits vs malt-based wholesalers: 70% of the off-premise market is uneconomical for Southern's to serve.

This research curates our work on Fever-tree’s distribution network and explores the risks and net-new account opportunity under Molson across c-stores, grocery and off and on-premise accounts.

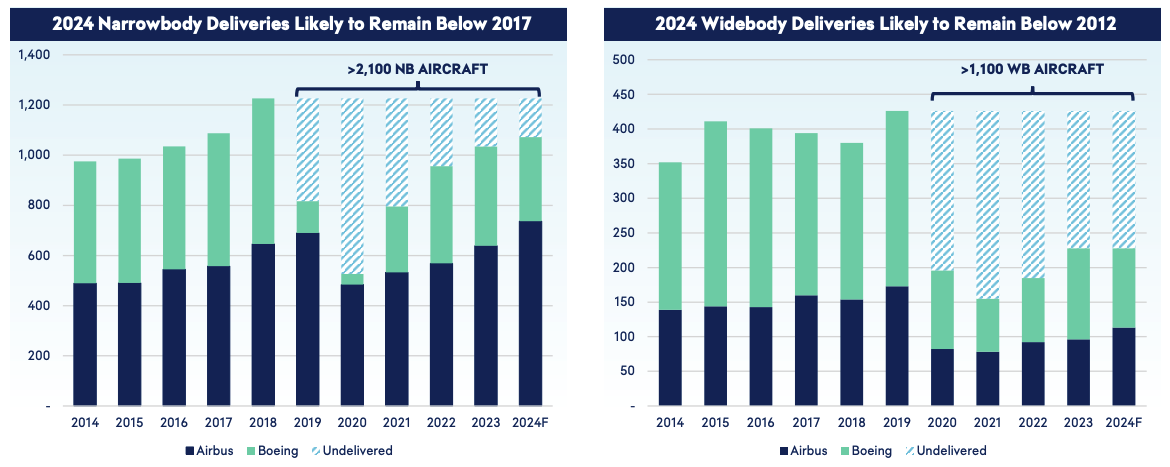

Earlier this month, we explored the undersupply in the commercial narrow and widebody aircraft markets:

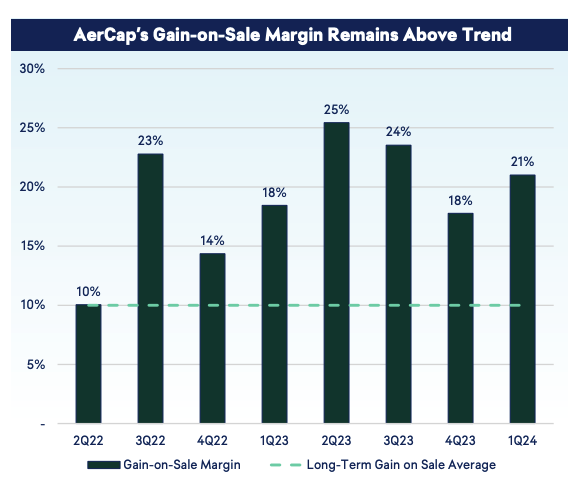

Aircraft undersupply has also driven higher demand for existing aircraft, higher lease raets, and higher gain-on-sale for lessors. Aercap's gain-on-sale has doubled over the last 3 years to 20%, well above its long-term average of 10%:

This interview with a 30-year aircraft leasing veteran explores how the market has evolved over the last 20 years, lease rate drivers, and changes in maintenance reserves. We also discuss the art of aircraft trading which is a key differentiator for lessors:

The trading department is crucial. Differentiation between lessors often depends on their trading skills. Some are adept at timing sales, usually selling with the lease attached. They mix new planes with good credit profiles and less desirable ones. Success depends on how well they manage this mix. - Former SVP, Avolon Leasing

A lessors' ability to forecast aircraft-type demand and trade planes to position the portfolio favourably five years in advance is a key driver of returns:

There are many considerations for trading older planes. You have a 12-year lease, and also what people don't realize is, let's say you have a 12-year lease with a mid-tier airline like Vietjet. It's a good customer, but not your top credit profile. Do you hang on to that lease for 12 years, or midway, do you sell this aircraft with a six-year lease attached? Let's say it's a neo, a sort of new technology. - Former SVP, Avolon Leasing

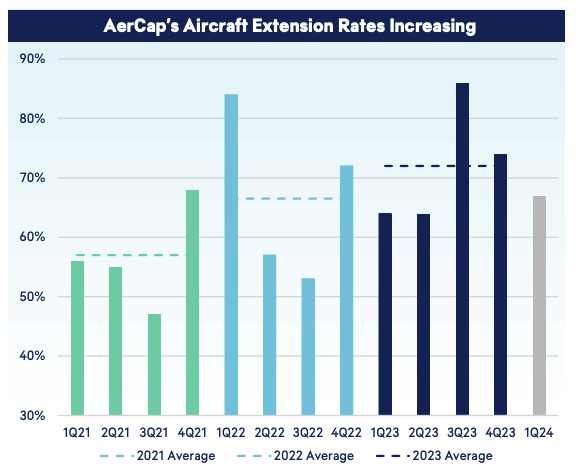

Lessors have also seen record lease extension rates. Customers are not returning planes at the end of the lease because aircraft supply is tight. This drives higher returns to lessors via lower transition costs. Aercap's extension rates have steadily been increasing over the last 4 years:

Lessors have done really well because, not necessarily at 12 years, but sometimes for older aircraft with shorter leases, if it's an old airplane, you want the airplane to stay there. If the airplane comes back and you want to lease it elsewhere, the lessee has all the maintenance burden of operating the aircraft and paying for fuel and maintenance. The lessor has nothing to do with that other than overseeing. But when you do a transition, it's the lessor's responsibility to prepare the aircraft for the next lessee. If the next lessee wants all economy and you have a dual-class cabin, or if they want an in-flight entertainment system with Internet, then it's up to the lessor to invest in that old plane because the next lessee wants it. - Former SVP, Avolon Leasing

The interview goes on to explore how lease rates may be plateauing this year:

What we're seeing now is a post-Covid massive increase in values and lease rates. Even last year was significant. However, I'm hearing that in 2025 there might be a plateau. For example, the A320 Neo used to be in the low 300s before Covid due to oversupply. Before Covid, there were too many lessors with too many positions, and the MAX was performing poorly. Last year, with Avolon, we expected $500,000 a month rent for a MAX, but we were getting low 300s. - Former SVP, Avolon Leasing

Geotek, acquired in May 2022, is the largest acquisition in JDG’s history. From inception until 2021, Judges had spent ~£60m in cash acquiring companies. The total transaction value to acquire Geotek was £80m excluding excess cash. Judges has spent more on Geotek than all other acquisitions combined. The total multiple paid was ~7x EBIT.

Geotek is the largest business within Judges and represents over ⅓ of the total group EBIT. In 2022, it contributed £20M in revenue and £11.4M in pro forma EBIT to Judges. In 2023, Geotek's EBIT declined to £10M, 9% below the 2022 earn-out threshold. In 2024, Geotek’s earnings contracted further due to the absence of a coring expedition. Judges’ share price is down more than ~45% from its all-time high and trades at ~23x FY25 adjusted EPS.

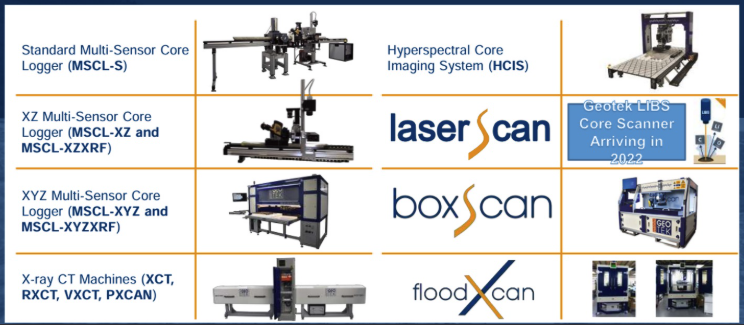

Geotek is a leading provider of multi-sensor core scanning equipment used to extract high-resolution geological data, with over 220 systems sold globally across mining, oil & gas, academia, and marine research. It is also the Group’s first acquisition to derive a significant portion of revenue from services.

This piece of research walks through Geotek’s business model, its competitive positioning, and explores the durability and risk to Geotek’s long-term earnings power and how this translates to Judges organic revenue and EBITA growth.

Related Content

FTAI: Module Swap Process

Former Sr. Vice President, Aircraft Leasing / Marketing at FTAI Aviation

Airbus A320: SOFITEC Panel Issues & 2025-2027 Production Impact

Former Director at Airbus

Embraer: Supply Chain Constraints & Production Scaling Challenges

Former Vice President of Embraer

Airbus SE: Fuselage Panel Challenges & Production Rates

Former Quality Director at Airbus

© 2024 In Practise. All rights reserved. This material is for informational purposes only and should not be considered as investment advice.