Copart, GEICO vs Progressive, Meta, CSU AI Risk, TransDigm Demand Drivers

Published Last Week

This interview with a Former GEICO Claims Officer, who ran and managed the RFPs to Copart and IAA, highlights the key variable for insurers when selecting a salvage partner:

Speed is the key KPI for carriers because a vehicle loses value the longer it sits. There's everyday volume, like when Steve and Jenna have an accident in the U.S. and a car is totaled. Then there are large-scale events, or catastrophes, usually weather-related, which significantly impact salvage volumes. - Former Claims Officer at GEICO

Speed is especially important during catastrophes because volumes are high and insurers aim to differentiate by resolving claims quickest:

During Hurricane Katrina in New Orleans, Louisiana, I made a decision to trust customers, even if we didn't know where the cars were. We believed they would eventually show up. In a major metropolitan area that had evacuated, waiting too long would put us at a disadvantage. So, we started taking people at face value. Our goal was to have 90% of the cars seen and 90% of the customers paid within two weeks, which was an aggressive model. - Former Claims Officer at GEICO

Historically, IAA has struggled relative to Copart during catastrophes:

Baton Rouge, Louisiana, prone to flooding, experienced a flood event with about 35 inches of rain in August 2016. IAA had the wrong plan and couldn't manage it, prompting me to consider if one provider could handle our volume or if we needed two. - Former Claims Officer at GEICO

Today, performance seems very close between the two major players and Progressive and State Farm, the two largest auto insurers, currently have RFPs out for tender:

The insurance industry has always disliked monopolies, and with two new operators at Ritchie Brothers/IAA mix, the industry has been closely observing their actions. They made significant changes, improving speed and, consequently, returns to insurance companies. IAA has improved in some ways, and currently, results across the ecosystem are considered neck and neck. Both Progressive and State Farm have issued RFPs, which are requests for proposals. These are typically sent to vendors or providers to ask for pricing based on volume. Progressive and State Farm have outstanding RFPs with IAA and Copart. This is significant because they are the two largest insurance companies in the country. Progressive is 50% larger than GEICO. A subtle shift in volume with Progressive or State Farm could significantly impact Copart and/or IAA. - Former Claims Officer at GEICO

The interview goes on to explore how IAA compares to Copart in hurricanes and why and how GEICO ran an RFP splitting volume between the two large salvage players. This interview can be read alongside the following interviews:

We published two interviews that explore case studies to understand the potential AI risk and opportunity for Constellation Software:

This quote is an interesting way of describing Topicus Education's switching costs:

The business remains very sticky because the software that Topicus is applying in Western Europe is quite modern and continues to be modernized. They are still innovating the software. Removing the software from businesses or government entities would be like replacing a person's spinal cord with another. It's deeply integrated and difficult to do. It costs a lot of money and requires a significant amount of man-hours. Most of the officers or customers Topicus works with think twice before making a shift. - Former Executive at Topicus

Topicus is quickly adopting AI after a slow start:

Initially, Topicus underestimated the impact of AI. Two years ago, during a summit in Toronto with various CEOs active at Constellation Software, there were different workshops. Only one out of 500 workshops was about AI. At that time, AI wasn't considered a big deal; it was more about reading, making films, or enhancing text. They didn't consider AI as a tool for building more code or creating insights from the vast information in our systems. It took about two years for Topicus to start thinking about doing more with AI. Interestingly, one person recently became the first AI lead at Topicus just two months ago. He has assembled a team of 10 people from various divisions at Topicus who are interested in AI. They have been focusing solely on AI for the past two months. Previously, only some DevOps enthusiasts were exploring AI on their own, but it wasn't regulated by Topicus. - Former Executive at Topicus

Vertical market software for government and public entities can use AI to drive down devops costs:

Seventy percent of the cost I had at Topicus was DevOps because everything we are doing is extensive. For example, if I had a proposition with revenue of about €10 million, I had 62 DevOps working on it. With AI advancements in vibe coding and prompt engineering, and the speed and complexity you can achieve in days instead of weeks, I can't see another way than Topicus postponing a lot of their DevOps in a few years. The revenue stream will remain the same or increase because you can create more solutions, but the costs of these solutions will decline over the years. I think it will decline extensively. The 60 people you need now might be reduced to 20 or 25 people in three years to do the same work. - Former Executive at Topicus

But AI will potentially disrupt the front-end user interactions and modules, not the proprietary data structures:

AI won't replace our proprietary data structures, hardware integration on vehicles, asset replacement planning, and capital investment strategies. I don't see a significant risk of AI replacing our core components, except in end-user interactions, which will include an AI component. - Former Portfolio Manager, Trapeze US

Both interviews explore in more detail where AI could be a risk for Constellation Software and Topicus' respective divisions. This can be read alongside our prior CSU research:

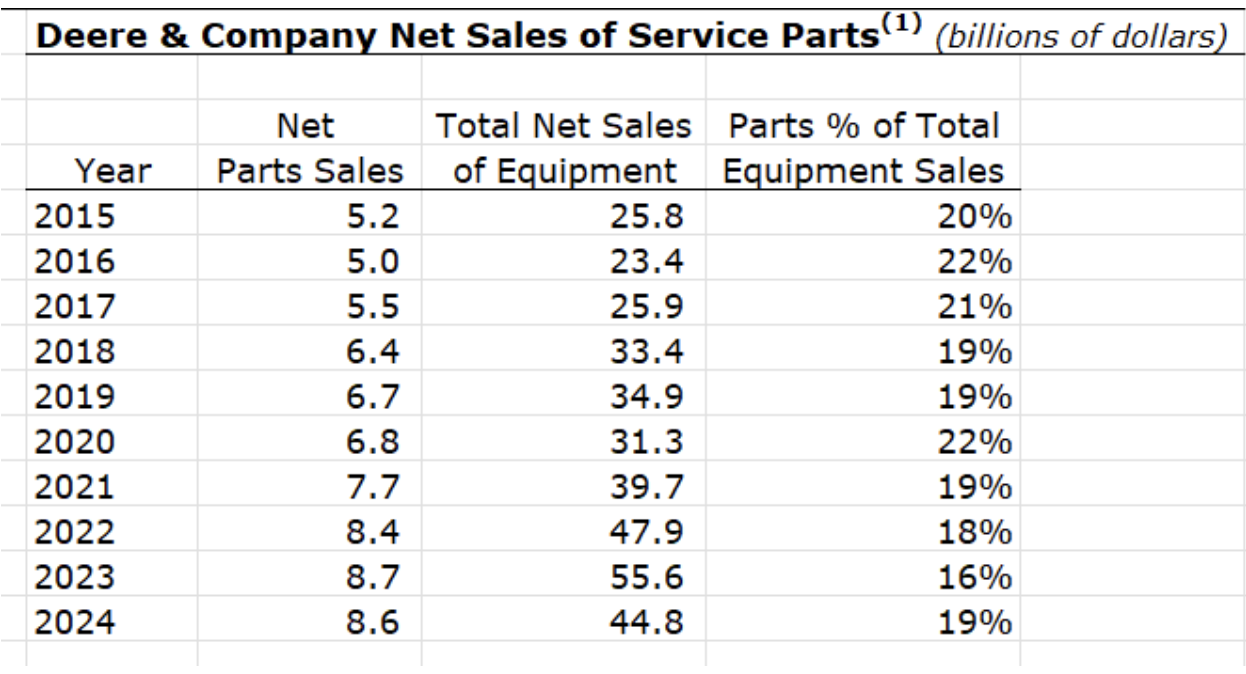

We interviewed a Former Parts Business Manager at the company who reported Deere earns +55% gross and +35% operating margins on net part sales. At 35% margins, Deere's part business generates an estimated ~33% of the company's total EBIT.

That mindset has always been there, but corporate considerations or goals around it really changed about five years ago. They went through a big reorganization and set up a new division called the Lifecycle Solutions division. That's when they really put the spotlight back on the parts business. It was set up as a separate unit with a separate president, separate financials, and the whole ball of wax. It was run just like a separate business starting about five years ago. Now, it's a critical piece of their business because it generates over $7 billion in revenue with about a 50% plus margin. The bottom line, if I remember correctly, is a gross margin between 55% and 60%. Their bottom line is 35% plus. - Former Business Manager at John Deere

Not only is the part business important due to its profit contribution, but it enables a level of service that others cannot compete with. Every percentage of equipment downtime is expensive for customers and Deere has scaled its part inventory pool and logistics network to minimise downtime that drives farmer efficiencies:

It was in the high 80s to low 90s, and a few percentage points difference means a lot. If John Deere says they can reach 95% of their dealers in two days and move that to 97% or 98%, it's extremely costly to buy those additional points of availability, but it makes a significant service difference. From the outside, you might think Deere has good service with 89%, 90%, 91%, or 92% availability, reaching dealers overnight. However, there's a massive difference between that and 97%. Deere pushed its logistics network as high as it feasibly could. - Former Strategy Director at John Deere

Deere is running at 80% dealership part fill rates and 90% part delivery within 48 hours. This translates into a lower total cost of ownership to farmers that competitors struggle to match:

Literally, 99% of the time, Deere will have the part. There might be some parts that are stocked out or in short supply, but it will be at a Deere warehouse. With Deere's logistics capabilities, that part can be sent overnight, within 24 to 48 hours, to your local dealer store. So, 80% of the time, the dealer has it; the 20% of the time the dealer doesn't, 99% of the time Deere has it, and in the high 90s, Deere can send it overnight. - Former Strategy Director at John Deere

This can be read alongside our prior work on Deere:

Related Content

Salesforce Agentforce: Data 360, Public Sector Agentic Workflows & CRM Positioning

Former Regional Vice President, Public Sector Digital Transformation, Salesforce

Constellation Software: UK Healthcare VMS & Selling to the NHS

Former Senior Executive at Constellation Software

Topicus: Dutch Primary Education and AI Risks & Opportunities

Former Managing Director at Topicus

Roper Technologies: Leadership, AI Strategy Execution Challenges & Customer Retention Risks

Former VP at Roper Technologies

© 2024 In Practise. All rights reserved. This material is for informational purposes only and should not be considered as investment advice.