Deere Dealership Economics, Adobe vs Figma, Copart, Cellavision

Across the US and Canada, John Deere sells its equipment through 2,000 independent dealer locations. This week we explore the economics of a Deere dealership and the underlying profitability of equipment servicing:

70% of our revenue dollars come from new and used sales, roughly split in half with 35% used and 35% new. Parts make up 20% of our business, and service accounts for 10% in terms of revenue. The margins are just the opposite. Service has a 70% margin, parts have 35%, and sales are about 5% to 6% - Current Deere Dealership Owner

Deere uses market share as a leading KPI to incentivise dealers:

Equipment pricing it's 100% discretionary. We can sell it at a loss if needed. There's another important incentive we receive from John Deere, which is the market share bonus. I'm responsible for roughly 110 counties across three states. My market share in these counties determines my bonus, if any. The bonus doesn't kick in until I reach a 60% market share, and it maxes out at 68%. Last year, for fiscal 2024, my market share bonus was $14 million. I achieved a 70% market share, maxing out the bonus at the 68% top tier, and received a $14 million check from Deere in December. This is a significant incentive for me to excel in selling new equipment - Current Deere Dealership Owner

As with many OEMs, Deere steadily loses share as a the equipment ages and customers choose third party repair vs Deere OEM parts. The interview explores how Deere is trying to win back spare part sales for mature equipment.

it's something like 90% in the first two years, dropping to 70% at five years, and at 10 years, we're down to 25%. It's becoming more difficult to find an independent repair shop due to the complexity of electronics and software in these machines. As for parts, we start losing out on more common parts like batteries, belts, and tires. These are easily purchased at an auto parts store or online at an ag parts retailer.- Current Deere Dealership Owner

These two interviews explore the competitive threat to Adobe from Canva and Figma:

"In my opinion, Canva is a bigger threat to Adobe because the whole SMB space is shifting to Canva. In Canva, you can do things you would do in Photoshop, Illustrator, and InDesign, all in one simple tool. Unless you need something very specific in terms of workflow, you might use Adobe desktop products. Otherwise, most people, especially those under 40, have shifted to Canva - Former Product Manager at Adobe

Adobe is well entrenched across organisations whereas Figma and Canva have adoption mainly with designers:

Will Figma eventually be as broad as Adobe? Adobe covers many departments, teams, and roles within an organization, which makes them indispensable. Companies buy Adobe because it covers many of their tool needs. It's hard to change from Adobe. The question is whether Figma will also try to expand horizontally. Designers have their tools, but Figma Dev and Fig cover the technical parts of teams, which is good. They may expand their addressable market because they are already reaching the peak designer-wise. - Former Senior Executive at Figma

Figma's product quality has created lifelong fans throughout its customer base:

Figma combines four tools in one - ideation, design, handoff, and prototyping. The process required four tools until Figma came along. By having four tools in one, there are time savings and improved quality with a faster design to market time, for example in the shipping of products and overall a super strong customer bonding. With Adobe, you needed two other tools to achieve the same output as Figma with just one tool. I've never worked for a company where the customers loved the company so much. There was a kind of cult around Figma where people would have merchandise, products, collect autographs - somebody even got a tattoo! They really managed to build a customer base that is essentially like a fan base. - Former Senior Executive at Figma

A Claims Manager at Progressive Insurance sheds light on the carrier's decision to steer 80% of its total loss volume to IAA vs 20% to Copart:

Over the years, we've become IAA's number one customer. They give us priority, like picking up vehicles quickly and providing better storage locations in the salvage yard, ensuring vehicles are in better condition when sold a month later. They've worked closely with us, and as we've grown, they've been very accommodating. Despite the acquisition by Ritchie Bros and issues others faced, we didn't have many problems because we were their VIPs, their priority - Former Claims Manager at Progressive

Even though competing insurance carriers like GEICO and State Farm have been doing the opposite as Progressive the past couple of years:

Several years ago, when many carriers started pulling business away from them due to poor performance, they were taking too long to pick up vehicles and were not well-organized at the salvage yard. However, they did a good job with us, which was different from the rest of the industry. They didn't have enough staffing and needed to prioritize, and they chose to stand by their number one carrier - Former Claims Manager at Progressive

This can be read alongside our other material on Copart and salvage auctions:

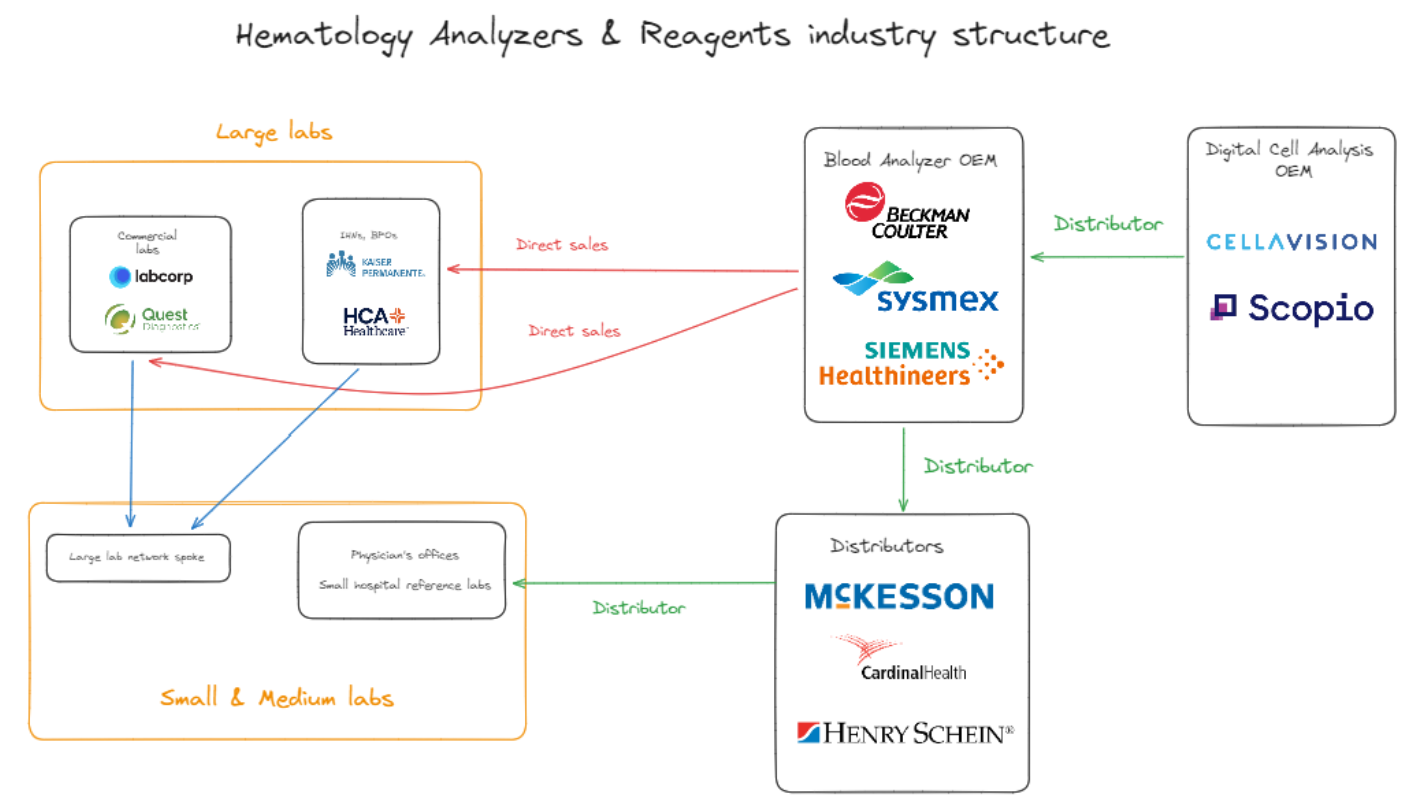

This piece of research curates months of work on CellaVision and the hematology equipment market. In the US alone, there are an estimated 2bn blood tests completed each year and the hematology analyzer and reagent market is estimated to be worth ~$4bn annually.

CellaVision is a $450m Swedish-listed supplier to blood analyzer OEMs such as Sysmex and Beckman Coulter. The company manufactures proprietary cell analysis products that are critical to analysing blood samples. This research breaks down the hematology industry structure and CellaVision's products and relationship with Sysmex, its largest customer.

Related Content

Root Inc: A Potential Data-Driven Advantage

Former Senior Executive at Root

Copart vs IAA: Building a National Salvage Network in Canada

Former Managing Director at Copart

Lonza vs WuXi Biologics: BIOSECURE Act & U.S. Manufacturing Strategy

Former Senior Business Development Executive at Lonza

Zeta Global: A Customer's Perspective

VP at MillerKnoll

© 2024 In Practise. All rights reserved. This material is for informational purposes only and should not be considered as investment advice.