Diageo, RTDs, & Don Julio, NVR Operations, Wise vs Currencycloud, Cartier & WOSG, GEICO

Published Last Week

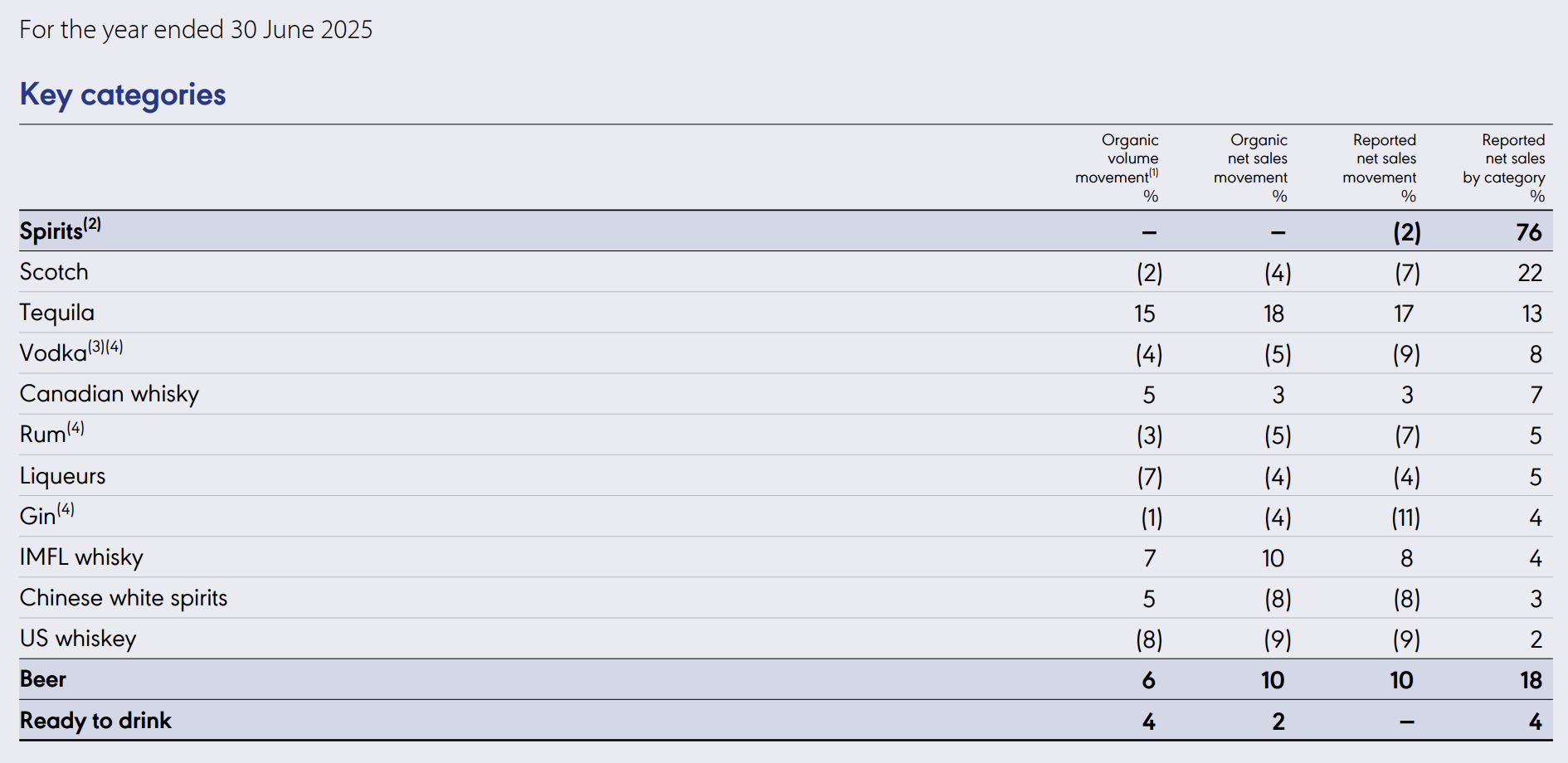

Year-to-date, Diageo’s stock is down ~20% down, and has also declined 20% over the past five years. Today, the company trades at ~15x NTM earnings, with ~1-2% organic sales growth. Diageo owns a portfolio of ~50 core brands that consumers have been drinking for decades; Johnnie Walker since 1820, Don Julio since 1942. The majority of its brands have stood the test of time.

Diageo’s management changes and current valuation piqued our interest to revisit the company. This interview with a former Diageo executive highlights a few interesting points that provide context to Diageo’s challenges beyond the well publicised changes in drinking habits and pressure on unit volumes.

One topic we explore is Diageo's RTD portfolio and distribution. Diageo is significantly underweight RTDs which is one of the fastest growing areas of spirits. In H1 25, RTDs accounted for ~4% of Diageo’s total sales compared to ~11% of the total spirits market.

We also explore the interesting recent news of RNDC exiting spirits distribution in California because it has lost share to a beer distributor.

It's shocking. I lead our business for California with Proximo. We were with RNDC, and now we're transitioning to Breakthru Beverage, the distributor we've chosen. RNDC had 500 suppliers and is closing its doors on September 1st in California. Reyes has taken the majority of that business - Former VP at Diageo

Our research shares context to why spirits companies are increasingly shifting volume from spirits to beer wholesalers and the potential impact on Diageo's organic growth. This can be read alongside our prior work on similar topics:

A Former President at NVR compares the company's operational discipline to competitors and the impact on the quality of the final product:

I think we build a much better home than D.R. Horton does. We're not just doing it for units; people care about it. For instance, when I was there, we monitored that nobody could have more than 10 homes under construction at one time. When you talk to other companies, we'd get people coming from Horton, LGI, and Lennar, and they'd have 70 homes under construction. There's no way to monitor quality at that scale. Often, subcontractors are driving the ship. They show up, aren't managed, do their work, and the next person covers it up. It was eye-opening to me that affordability often trumps quality in terms of volume for these home builders. All the big ones are in the same boat, doing high-volume, big-box, efficient work. I used to think quality mattered more, but affordability is a huge pressure now. When I was growing up, it was more affordable for my wife and me to buy a first home. It's not anymore. If you can dominate in quality, efficiency, and cost, I think those builders will rise to the top. - Former President at NVR

The interview also explores how NVRs stock option plan drives employee retention:

everyone gets about 5% of their last year's income in NVR stock. If someone leaves before their stock is vested, which is a five-year vesting schedule, that money goes into a pool. So, if you make $100,000, you're getting $5,000 to $7,000 in stock every year for free. There were secretaries retiring after 30 years with a million dollars in free ESOP. - Former President at NVR

Visa acquired Currencycloud in 2021. Currencycloud co-Founder shares insights on how Wise is disrupting FX:

I don't think price is the main factor here. Remember, this isn't a winner-takes-all market. What Wise is trying to achieve is bold and ambitious. They're aiming to change how foreign exchange markets work. Typically, the FX market is optimized for speculative and leveraged trading, which constitutes the majority of the volume. Then there's the deliverable element that consumer business parents go through. Wise is trying to change the market to a distributed in-country system, with float in different locations, creating a global netting infrastructure instead of one that goes through London, New York, and an Asian hub. If you're asking whether you should invest in Wise, I wouldn't bet against them" - Cofounder of Currencycloud

This interview can be read alongside various others on Wise:

A Former Cartier VP explores its wholesale partner mix of mom and pop independents vs bigger groups like Watches of Switzerland:

Based on my experience at Cartier, particularly with the smaller shops, when I joined Cartier, my team informed me that in the year prior to my joining, they had cut at least 100 small distribution points. These were very small distribution points. Historically, brands like Cartier would hand over a little bit of product and inventory to every distributor, especially in the US. Initially, Cartier had almost 300 different partners of various sizes. They reduced this number to 150, and during my tenure, it went down to around 100. Within these 100, there's a significant difference between top partners like Watches of Switzerland and Bucherer, and everyone else. To answer your question, while I can't predict the future, I don't foresee any short-term risks of dropping partners like Watches of Switzerland for a brand like Cartier. The wholesale business in Cartier, within the Richemont Group, accounted for about 10% to 15%, making it a very relevant part of the business - Former VP at Cartier

Related Content

Prada Group: Miu Miu Strategy, Brand Verticalization & Leather Goods Growth

Former Head of Retail Training Leader at Prada Group

Mastercard: Culture, Leadership & The Ajay Banga Transformation

Former Senior Vice President at Mastercard

Adyen vs Stripe: Payment Facilitator Economics

Chief Operating Officer at Zenchef

Mastercard & Visa: Services Revenue Strategy and Value-Added Services

Former Senior Vice President at Mastercard

© 2024 In Practise. All rights reserved. This material is for informational purposes only and should not be considered as investment advice.