Formula 1, Microsoft Copilot, Netflix, Adyen, Subprime Autos, WIZZ, Veralto

Published Last Week

This is an interesting interview with a Former LLM & AI Engineering Director at Azure, who trained the first three generations of ChatGPT on Azure, who discusses the divergence of MSFT and OpenAI strategies, challenges with current LLMs, and the profitability of Copilot.

One potential takeaway from the interview is that AI isn’t pulling in enough non-AI workloads to Azure to cover the costs of training models:

It's not happening at the rate we need, and we're losing money on the LLMs. Now, it's more expensive with LLMs. The cost per compute is high, and we're losing money on that. Hosting services like Azure AI Studio is costly. They lose money to pull in workloads, and if they're not doing so quickly enough, they won't cover the costs. It's expensive on both the compute and infrastructure sides. - Former AI / LLM Engineering Director at Microsoft Azure

Pulling in non-AI workloads is critical to drive profitability.

For example, a company might have some things on-premises, some in AWS, and also Azure. They use AI as a carrot on a stick, which used to be break-even but wasn't too expensive on the compute side. Now, deep research areas are very expensive. OpenAI is losing money significantly, just like us. It's not a break-even motion on the AI side to entice pulling in real money-making workloads where we have margins. It's a money-losing strategy to try to pull in those workloads, and it's not happening fast enough. That's why you saw the automatic uptick in the Office 365 price—they had to do it. - Former AI / LLM Engineering Director at Microsoft Azure

The interview goes on to explore how Microsoft is structured, Satya's internal product development process, and Microsoft's OpenAI relationship. This final comment on Azure’s ‘moat’ is food for thought:

"Moat" is a tricky word. I don't believe they have a moat. Initially, you might consider the leverage position of a company like Walmart, which gets significant discounts. I actually worked at a consultancy that collaborated with Walmart's leadership. They were engaging with companies like Rackspace, which offered different services, just to negotiate better terms. Walmart knows how to negotiate well. In contrast, consider a company like John Deere, which gets substantial discounts for Azure commitments but lacks similar leverage in their development environments. That's the key area. I don't think they have a moat. The initial buzz around OpenAI and its models might have boosted sales, but it wasn't enough to drive the main workloads, as you mentioned. It's not about AI losing money for Microsoft right now; it's about pulling through the profitable workloads. This has always been true with machine learning and data. - Former AI / LLM Engineering Director at Microsoft Azure

This is the first interview in a series of research on Formula 1 Group and the recent MotoGP acquisition. This interview with a Former Formula 1 Media Rights executive explores the history of Formula 1 and pay TV:

Under Bernie Ecclestone, the plan was always to keep Formula One on free-to-air TV. The BBC and Channel 4 in the UK held onto Formula One as one of the last major global sports properties. The Premier League had sold out 15 to 20 years earlier, accepting the money from pay TV. In any highly engaged market, pay TV becomes inevitable. - Former Senior Executive at Formula 1

And explores the long-term potential for F1TV Pro to cut out pay TV distribution:

So, do we reach a point where Formula One decides that F1TV Pro works well, is super reliable, and starts cutting off some media rights deals to experiment in different territories? You might get a million viewers on Sky Sports because people are home on a Sunday afternoon and want to watch something, so they watch the race. If you switch to direct-to-consumer via F1TV, your audience might drop. Does it drop to 10%? It's not a bad estimate, I would expect. I believe you'll see increased sampling and trialing in smaller markets with direct-to-consumer like F1TV Pro. If it works well, you have to assume it will be rolled out in most markets. - Former Senior Executive at Formula 1

Over the next few weeks, we will publish various other interviews on Formula 1 and MotoGP.

As part of our NFLX coverage, we’ve been studying how the company creates international content and the potential scale advantages creating local content relative to Amazon and Apple. This interview with a Former Netflix India leader shares how Indian consumers come to Netflix for local content first:

In tier 2 cities, people will watch shows like "Money Heist" only after they become extremely popular and are dubbed in Hindi. People do not primarily come to Netflix to watch global content; they come for local content. This is true even for tier one cities. Our research shows that people love watching local content first and expect it to have premium quality similar to global content. However, they are more forgiving of Indian content's production quality and storytelling. They are more likely to sample local content than international hits. Initially, Netflix's content strategy was about 60% to 70% global content, targeting an English-speaking audience. Now, that has changed to about 40% global and 60% Indian content, which is the case for 2022, 2023, and 2024. - Former Originals Manager at Netflix India

Netflix has potential scale advantages in attracting the best creators:

The primary reason is market dynamics. Netflix offers the most funding for production, which means they can support larger creative visions that require significant budgets. Other platforms, like Amazon, might only be able to fund one such project per year or every two years, whereas Netflix can do it more frequently. Therefore, if you have a dream vision for a show or film, Netflix is more likely to make it a reality compared to other platforms. Another reason is Netflix's ability to take local content and place it on a global stage. Every show or film gets released in 190 countries and is marketed there. Netflix has the capability to take creators to various festivals. For instance, "Delhi Crime" won an Emmy, a first for an Indian series. This achievement highlights the desire to stand alongside international creators, which only Netflix can facilitate. Netflix's marketing and publicity efforts for content and creators surpass those of local players. For creators aiming to reach a global audience and discuss their content internationally, Netflix is unparalleled. Even if Netflix isn't the only option, the marketing investment they put behind each show and film is significantly higher than any other platform. This is another reason why creators prefer working with Netflix over others - Former Originals Manager at Netflix India

This IP Research Roundup curates our recent work on the US auto subprime market comparing lending models and underwriting quality of companies such as CACC, CVNA, and Westlake. Subprime seems an unloved yet critical and profitable subsegment of the market. Traditional banks don't seem to have the underwriting history, data, or risk tolerance to enter at scale. This leaves companies such as CACC to earn 30%+ ROEs through the cycle.

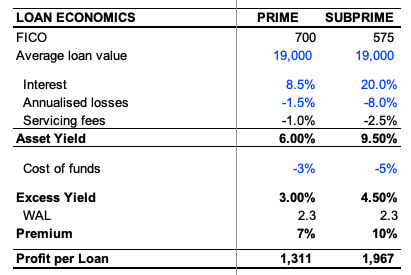

Carvana is also a large subprime lender. The company finances ~80% of retail sales, which contributes more than 50% of the company’s gross profit. Carvana runs a direct lending model, selling the vehicle and originating both prime and subprime loans. CarMax owns and originates loans for prime customers but outsources subprime. Around 40-50% of Carvana's loans originated are subprime. Given subprime loans are more profitable than prime loans, a significant portion of CVNA’s underlying profitability is driven from subprime financing. While rates are significantly higher than 2022, this old piece of research shares rough differences in unit economics between prime and subprime loans:

This IP Research roundup curates all our learnings and helps navigate some of our work on this topic over the last few years.

Related Content

AWS: Securing Grid Power for Hyperscale AI Data Centers

Former Executive Leader, Energy Strategy and AWS Infrastructure at Amazon

Confluent vs Open Source Kafka: Enterprise Adoption & Pricing

Current Data & AI Senior Manager at Accenture

Intapp: DealCloud Acquisition & Managing License to SaaS Transition

Former Finance Manager at Intapp

Intapp: Revenue Operations, Go-to-Market Strategy & Cross-Sell Opportunities

Former Vice President at Intapp

© 2024 In Practise. All rights reserved. This material is for informational purposes only and should not be considered as investment advice.