IP Research Offering

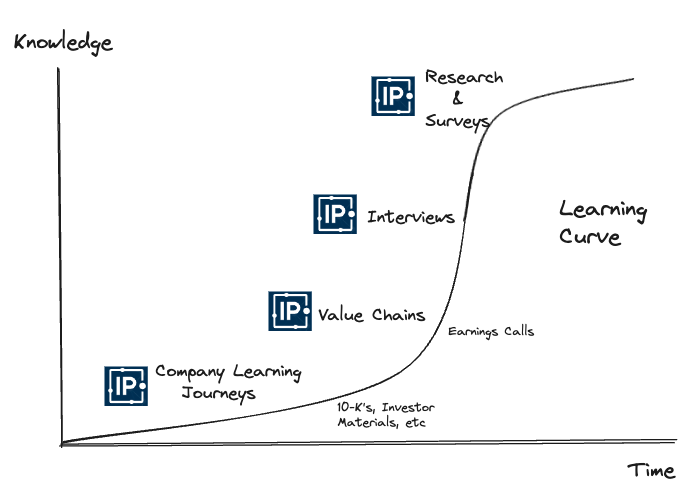

View Upcoming ContentIP Research offers a new format of investment research built upon our internal primary research process.

We focus on sourcing and interviewing the best executives on each industry and company we study. We curate the learnings of our primary research into written analysis to help investors understand how companies operate. No EPS estimates or short-term focus. We explore how value chains are structured, drivers of a company's unit economics, and just how a company operates. All our research is focused around understanding the long-term durability of earnings.

Content Formats

For each company, we source multiple executives to interview privately or publicly and curate insights to produce a research in three format types:

IP Analysis

Analysis built upon internal primary research conducted publicly or privately with executives within our network. Analysis can be in the form of written reports or a survey format. We aim to focus on 1-2 specific questions that drive the thesis of a large cap, quality company.

Value Chain Analysis

Aim to help investors understand the mechanics of value chains in industries where structurally advantaged businesses compete. We explore how units flow from suppliers to customers, the bargaining power across value chains, and the durability of structural advantages of large cap, quality companies.

Midcap Company Profiles

Help investors get up to speed on the core drivers of a company as effectively as possible. Profiles focus on global quality companies less than <$10bn in market value and less covered by other research institutions.

How is IP Research different

We believe curation and signal matter more than ever. The increased short-term focus and embedded bias of the sell-side combined with the explosion of executive interview transcripts leaves a gap for quality, curated qualitative research from a trusted source.

IP exists to fill this gap: we have over 2,600+ hours of experience conducting primary research interviews and the internal capabilities to source executives from any company globally.

Unlike other research shops, we will never cross-sell or earn commissions from broking or trading services. We will not receive any fee from any company we cover. We're focused on producing the best qualitative research globally on great businesses for long-term investors.

Ultimately, it's our mission to help investors and ourselves understand and build conviction to invest in the best companies globally.

Team

Each piece of research is led by Co Founder William Barnes and supported by our internal team of analysts. We are a team of generalists.

We're not experts in any one sector, but we do have the collective expertise of all executives in our network to learn from. Our team is structured and focused on utilizing our network to gather and share insights on quality companies globally.

Our approach to coverage

We have a small rolling list of large and mid-cap businesses (below) that we choose from. Exactly what and when we cover a company depends on the quality of executives available and the insight gathered from our research. We constantly remove and add companies to each list as our research progresses.

Our focus is on quality, not volume of output. We cater to the highest denominator: each piece of research aims to offer incremental insight to existing long-term shareholders of every business we cover.

Upcoming Coverage

What kind of patterns qualify a company for IP Research coverage?

-

Owner-operator: management’s economic fate is intertwined with that of the business

-

High integrity management

-

High quality governance

-

Management focus on ROIC and FCF per share

-

Business is customer obsessed

-

High ROIC and focus on ROIIC

-

Structurally advantaged business model (brands, scale economies, network effects, low cost operators, etc)

-

Companies with a long growth runway

-

Win-win dynamic: customers, employees, suppliers, shareholders, regulators, local community are all winning as a result of the growth of the business

-

Stable legal jurisdiction

Large Cap Coverage

-

Transdigm & Aero Aftermarket

-

Danaher, Sartorius & Bioprocessing

-

Markel & E&S Insurance

-

Progressive

-

Brown & Brown

-

Applied Materials

-

Constellation Software

-

Google

-

Costco

-

Verisk Analytics

-

HEICO

-

Tesla

-

Airbnb vs BKNG

-

Spotify

-

Amazon

-

Fastenal

-

Eurofins Scientific

-

Roper

-

POOL Corp

-

Apollo, KKR, & Alts

-

Diageo, Pernod & Spirits

-

Uber

-

Sherwin-Williams

-

Watsco

-

CME

-

KLA, LAM

-

ASML

-

Ferguson

-

Microsoft

-

Liberty Media Empire

-

Spirax Sarco

-

Atlas Copco

-

Intuitive Surgical

-

General Electric

-

Howmet

-

Align Technology, Straumann, and Envista

-

Floor & Decor

-

FICO

-

Netflix

-

Moody's / S&P

-

Old Dominion & LTL Trucking

-

LVMH, Hermes, Brunello Cucinelli

-

Assa Abloy

-

Rolls-Royce

-

Ametek

-

Copart

-

Ashtead vs United Rentals

Midcap Coverage

-

Appfolio

-

Graco

-

Procore

-

Veeva

-

FTAI

-

CCC Intelligent Solutions

-

Guidewire

-

Bergman & Beving

-

The Trade Desk

-

Diploma PLC

-

D'Ieteren

-

Judges Scientific

-

Rightmove, Scout & Classifieds

-

ACV Auctions

-

Burford Capital

-

Dino Polska

-

Ryanair

-

Röko

-

Applovin

-

Veralto

-

Mainfreight

-

IMCD

-

Credit Acceptance

-

Fast Fashion: ASOS vs Zara vs Shein

-

Fever Tree

-

Admiral Insurance

-

XPEL

-

Howden Joinery

-

Keyword Studios

-

Evolution Gaming

-

Basic Fit & Discount Gyms

-

Kinsale Capital Group

-

Wayfair

-

Verra Mobility

-

O'Reilly Automotive

-

Lumine

-

Interpump

-

Technoprobe

-

GVS

-

Terravest

-

Essentra PLC

-

Rational AG

-

GoEasy

-

Baltics Classified Group

-

Wingstop

-

CarMax

-

Carvana

-

Just Eat Takeaway & Online Food Delivery

FAQs

Can you provide an example of the type of IP Research you produce?

An answer is best explained using an example: our recently published Competitive Analysis on Constellation Software. We privately interviewed 10+ executives from private competitors of CSU.TO to understand two things:

- Private VMS acquirers' strategy: what they are buying, multiples, sectors, deal structure, etc

- How this may impact CSU's ROIIC and FCF deployment runway

These interviews were conducted privately by our team and weren't published in our library. Insights from the interviews and our own research were published in a research report.

We believe such research not only helps investors build an understanding and conviction on CSU.TO, but it saves significant time and research cost. If a client were to conduct such research internally, it would cost ~$15k in executive interview costs and 50+ hours of analyst time.

This is the time and cost for just one report. We aim to publish 30-40 such pieces throughout the year.

What is your process for producing Enterprise Research?

All IP Research is built upon our primary research process that we've refined over the last 8 years and 2,500+ executive interviews.

For each company in our coverage, we have 1-2 hypotheses that we believe drive the long-term investment case and that we wish to test. We aim to source the best executives globally to help us test each hypothesis.

For example, we're working on the following questions:

- Costco's European Opportunity: we're interviewing Country Managers for each EMEA country to understand COST's potential growth opportunity

- TransDigm: How much of post-acquisition EBITDA improvement is from price vs operational improvement?

We will source and interview executives from our network to explore both questions. Depending on the executive, some interviews are published in our interview library and some will be privately conducted by us internally.

How many pieces of research do you produce per year?

We aim to publish 3-4 pieces per month. The cadence of publication may be somewhat irregular as our focus is on publishing quality over quantity and it relies on sourcing the best executives. Without sourcing unique executive insight, we have no material to publish.

How do you choose companies to cover?

We have a small internal coverage list of companies we're interested in across large and midcaps. We constantly add and remove companies from our coverage list throughout our research process.

What we cover and when we cover certain companies depends on the availability of executives and the quality of insights we collect from our scuttlebutt.

Who writes the final research report?

All final research reports are written and approved by Co-Founder, Will Barnes. Our team of analysts also conduct executive interviews to support the research process.