Deere & Co: Software Portfolio

A few weeks ago, we published a research piece on Deere’s Operations Center and how its competitive moat may be expanding as the company gains greater control over the farm ecosystem. This research piece focuses on Deere’s software portfolio.

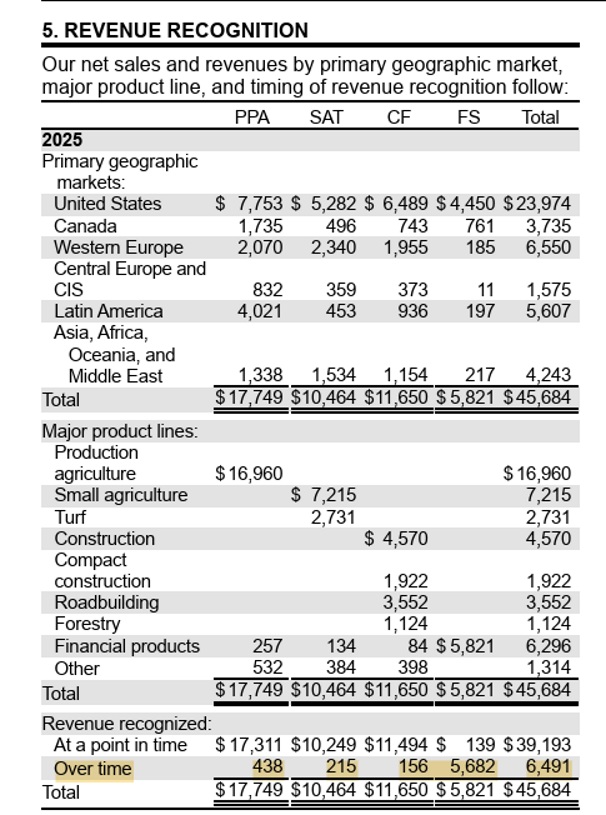

Deere has been laying the foundations for its software expansion for nearly two decades. Despite this long-time period, the scale of its software business remains modest. Today, Deere generates only a few hundred million dollars of software revenue within large-scale agriculture, excluding perpetual licenses. In its 2025 Annual Report, the company reported over $400 million in Production and Precision Agriculture (PPA) revenue recognized over time, primarily from auto-steering subscriptions:

The journey for the PPA segment to-date has been largely through monetizing solutions by adding them to base and by increasing take rates on additional features, to a much lesser extent, on subscriptions. With the new strategy, the PPA business is now poised to grow the recurring revenue aspect of their business which we believe can add higher margin potential over time. Today, the recurring revenue that we have is relatively small, primarily focused around guidance, subscriptions in terms of correction signals, so it is a small portion today - Q1 2022 conference call

Free Sample of 50+ Interviews

Sign up to test our content quality with a free sample of 50+ interviews.

Related Content

Deere: Fieldview Brazil Data Quality & Operations Center Competition

Former Fieldview Latam Director

Deere & Company: Culture Drift & Employee Morale

Former Lead Artchitect at John Deere

CNH vs Deere : Go To Market & Dual Brand Strategy

Former Sales Director at a CNH Equipment Dealer

Deere & Co: Precision Agriculture & Operations Center

© 2024 In Practise. All rights reserved. This material is for informational purposes only and should not be considered as investment advice.