IP Research 2023 Round-up

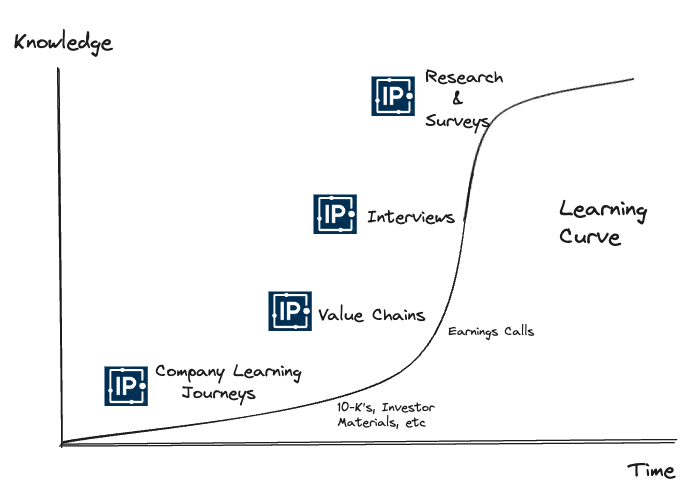

This email is a roundup of research we published in 2023. Our research is built from hundreds of hours of internal primary research.

We have four formats of research that each aim to cover a section of an investors’ learning journey:

1. IP Research Analysis - specific pieces of research on 1 value driver for a company

2. IP Value Chains - a breakdown of an industry or market value chain

3. IP Surveys: written surveys on 1-2 core drivers of an investment thesis

4. IP Company Learning Journeys - a company learning journey curating all primary research on our platform

In 2023, we’ve built out our team to source the best executives and publish great interviews to share insights across our research formats.

We see IP Research as an extension of your team: an outsourced group of analysts conducting primary research that you may not have the time or budget to complete.

For example, just one Research Analysis piece may cost $10k in executive interview costs plus 100 hours of analyst time to produce. A survey cost is similar. As our team grows, our coverage expands and the value proposition compounds over time.

In 2024, we plan to sustainably grow the volume of interviews and research published whilst consistently improving the quality. Please do reach out if you have any companies you'd like us to cover or any specific questions that could be a good fit for a survey or analysis research format.

IP Research Analysis

1. Amazon, Fedex, & Shopify Fulfilment: Advantages of Multi-Wave Dispatch: how AMZN’s network is designed for multi-wave parcel dispatch compared to single-wave at incumbents and the impact on throughput and variable and fixed cost per parcel vs Fedex / UPS.

2. Amazon: How a Unit Flows through the Network & Unit Costs: walk through AMZN network design and how a parcel moves from supplier to FCs, sortation centers, delivery stations, and to customers, compared to the cost and speed of outsourcing parcels to UPS / Fedex.

3. Constellation Software: A Competitive Analysis: how 34 private VMS consolidators compete with CSI, potential impact on CSI organic growth and ROIIC, and potential talent retention challenges at CSI

4. Amazon Advertising: Decoupling from GMV: breakdown of AMZN advertising products between non-endemic and endemic, how multi-touch and closed-loop attribution works, and the strategic value of AMZN marketing cloud.

5. Roko: Sector-Agnostic vs Sector Focused Acquirers: Roko’s M&A framework, minority vs majority interests, sector agnostic vs sector-focused acquirers, portfolio analysis, and Roko's potential limitations to scale

6. Diploma PLC: Leadership and M&A from Bruce to Johnny: history of DPLM org structure and evolution under new management, and character references on current CEO.

7. Costco UK & Europe: History, Economics, and Store Opportunity: case study of Costco’s UK expansion, why its operating margins are lower than other countries, and challenges and opportunities across Europe for COST model

8. Costco: Multi-Vendor Mailers & Merchandise Margins: how Costco’s promotional calendar and MVM offering works, its impact on gross margin, and potential risks of expanding the volume of MVMs to Costco’s value proposition

9. Constellation Software: Altera Analysis: breakdown of Altera history, performance, churn, how CSI could improve performance relative to Acceo (its first large LBO), and outlook on Altera IRR

10. Constellation Software: 5 Key Operational Metrics: breakdown of the 5 operating metrics CSU uses to manage VMS opco cost structure to optimise FCF.

11. HEICO: Wencor Acquisition Synergies and Analysis: how Wencor assets fit into HEI portfolio across PMA, distribution, and MRO, and why ABOM strategies are important for HEI

12. TransDigm: Boeing vs OEM Supplier Bargaining Power: how and why TDG has power over airframers, how Boeing looked to combat TDG pricing power, and potential risks to TDG from airframers

13. HEICO: PMA vs OEM Power: how airlines make decisions between OEM, PMA, DER, and USM parts, strategies OEMs use to combat PMA adoption, and other risks to PMAs

14. Burford Capital & Litigation Fair Value Accounting: comparison of pre and post-SEC accounting changes to BUR fair value accounting methods and impact on book value.

15. Burford Capital Valuation Framework: breakdown of BUR-only core litigation earning power, YPF asset value, and asset management value per share.

16. Amazon Retail: A Valuation Approach: step-by-step walk through how to split AMZN retail P&L from consolidated P&L, ecommerce gross and contribution margins, fully-loaded margins with and without subs and ads, and long-run EBIT margin outlook

IP Value Chains

1. Spotify: Podcast Advertising Value Chain: how $1 of ad spend flows through value chain between host, ad network, Spotify, and exchanges for programmatic and direct podcast ads for top shows like JRE and low-end inventory, the value of Megaphone, and challenges with programmatic podcast advertising.

2. Wayfair: CastleGate vs Drop Shipping Unit Flow: walk through how a sofa flows from Vietnam to the US as a dropshipped vs CastleGate order, and value of Wayfair CastleGate to suppliers and customers.

3. SHEIN's Supply Chain: How it Works: how SHEIN’s supply chain drives 2-week lead times, sampling, fitting, and cutting process, fabric buying and sustainability, test-and-repeat strategy, and order unit economics vs Zara.

4. Zara's Supply Chain: breakdown of how Zara structures its supply chain for short and near-lead items, differences between cut, make, sew, and FOB models, pre-production process and lead times, and merchandising challenges across ecommerce and stores.

5. Boeing, TransDigm & Commercial Aerospace: An Inverted Pyramid: explores the history of the commercial aerospace supply chain, why the 787 was a turning point in outsourcing manufacturing, and the bargaining power of OEMs vs airframers.

1. Burford Capital: Law Firm Survey: why and how law firms use litigation finance, pricing, and the risk to future funder IRRs

2. Wayfair CastleGate: Supplier Survey: why, how, and which inventory suppliers use through CastleGate vs dropship, challenges driving CG adoption, and how Wayfair can improve its overall offering to suppliers.

3. Credit Acceptance: Dealer Survey: why independent dealers use CACC to originate loans, challenges driving loan volume, and what dealers think of CAPS vs competing systems.

IP Company Learning Journeys

1. ACV Auctions: walk through how the US Wholesale auto market is structured, physical vs digital auctions, and how ACV is differentiated

2. Amazon Retail: how a unit flows through AMZN network, multi-wave dispatch vs single wave at Fedex / UPS, breakdown of shipping cost per unit, decoupling AMZN Retail P&L from consolidated accounts and non-endemic vs endemic advertising opportunity.

3. AWS: switching costs, the role of Kubernetes, the value of Graviton and hardware integration, Azure vs GCP vs AWS, Data Centre economics, and AWS’ partner ecosystem

4. Bergman & Beving: history of B&B, portfolio quality, comparisons with Lagercrantz in early 2000s, the challenges with Luna, and outlook on ROIIC.

5. Burford Capital: litigation finance as an asset class vs other alts, corporate vs law firm finance, risks to IRR, case origination and the relationship between funders and law firms, YPF, fair value accounting.

6. Constellation Software: how private VMS consolidators are competing with CSU, core operational KPIs to manage VMS, case study of Allscripts and Acceo LBOs, durability and risks to ROIIC.

7. Costco Wholesale: how COST culture changed under Jelinek, how COST buying function operates, strategies to cut costs with suppliers, how COST expanded in EU and APAC, challenges expanding internationally

8. HEICO Flight Support Group: structure of commercial aero aftermarket, OEM vs PMA certification process, value of HEI vertical integration across MRO, distribution, and PMA, Wencor acquisition and the strategic value of ABOM strategy.

9. Howden Joinery: UK kitchen market structure, how Wren competes with HWDN, and historical and future international store opportunity

10. Judges Scientific: UK scientific instrumentation market structure, JDG portfolio, Geotek product mix, M&A economics, valuation framework

11. The Gym Group & Discount Gyms: explores UK gym market structure, BFIT vs GYM unit economics, and the durability of mature gym ROIC and the value of fortressing.

12. TransDigm Group: TDG bargaining power vs Boeing, value-based pricing techniques, operational strategy post-acquisition, shipset model dynamics, risk from PMAs, case study of Korry Electronics.

13. Wayfair: fundamentals of W vertical integration, home furnishings pricing power, how a sofa flows through dropshipping vs Wayfair CastleGate, IKEA e-commerce setup, and questions surrounding Wayfair’s competitive advantage.

Recent IP Interviews

We have also covered companies with multiple interviews covering specific research questions:

Carvana vs KMX: as part of our work on vertically-integrated retailers, we’re exploring the differences of how vehicles move from wholesale or trade-in to customer purchase at KMX and CVNA to understand unit costs and overall customer experience:

Fever Tree - aside from exploring the US bottling and logistics challenges and impact on gross margin, we’re studying the potential long-run structural distribution advantage of FEVR in the US vs other premium mixers and how this can be replicated internationally outside of the UK:

Intuitive Surgical - a key area of exploration is how a Da Vinci is sold to hospitals and how new entrants can undercut and compete with ISRG:

Evolution Gaming: a key focus of our research is understanding EVO’s operations in APAC and how GGR flows through B2B aggregators across EU and APAC and how Pragmatic Play can compete:

Mainfreight, ODFL, & Fundamentals of LTL Networks: our research focuses on understanding the fundamentals of LTL networks, how they scale, its moat, and how new entrants like MFT can compete with incumbents such as ODFL:

Dino Polska & Polish Grocery Retail: we’ve been studying the sustainability of Dino’s growth, how it's differentiated from Biedronka and other competitors, why its meat counter is unique, and the durability of its earning power.

© 2024 In Practise. All rights reserved. This material is for informational purposes only and should not be considered as investment advice.