Credit Acceptance

History of Credit Acceptance

In 1972, Don Foss founded Credit Acceptance (CACC) to collect payments from car buyers of his dealership chain. Some years later, Credit Acceptance started collecting payments on behalf of the dealers in return for 20% of the total collections as a servicing fee. The remaining 80% of collections was paid back to the dealer, now termed "dealer holdback".

Problems with this offering occurred when customers failed to pay early instalments; without early customer repayments, dealers could lose money on the car. To solve this issue, Credit Acceptance started paying an advance to the dealer at the time of purchase. When added to the customer’s down payment, the total amount received by dealers (down payment from the customer + advance from Credit Acceptance) would cover the cost of the vehicle and protect dealer gross metal profitability This model forms the foundation of CACC's offering today and incentivized dealers to send more deals to Credit Acceptance over the last 50 years.

Market Size and Market Share

“The auto finance market is large and fragmented, with $1.3 trillion in outstanding loan balances as of December 31, 2021… Our potential customer market is large. Approximately 40% of adults in the United States have a credit profile that is considered less than prime. That's roughly 100 million adults.” - FY 2021 Credit Acceptance Letter to Shareholders

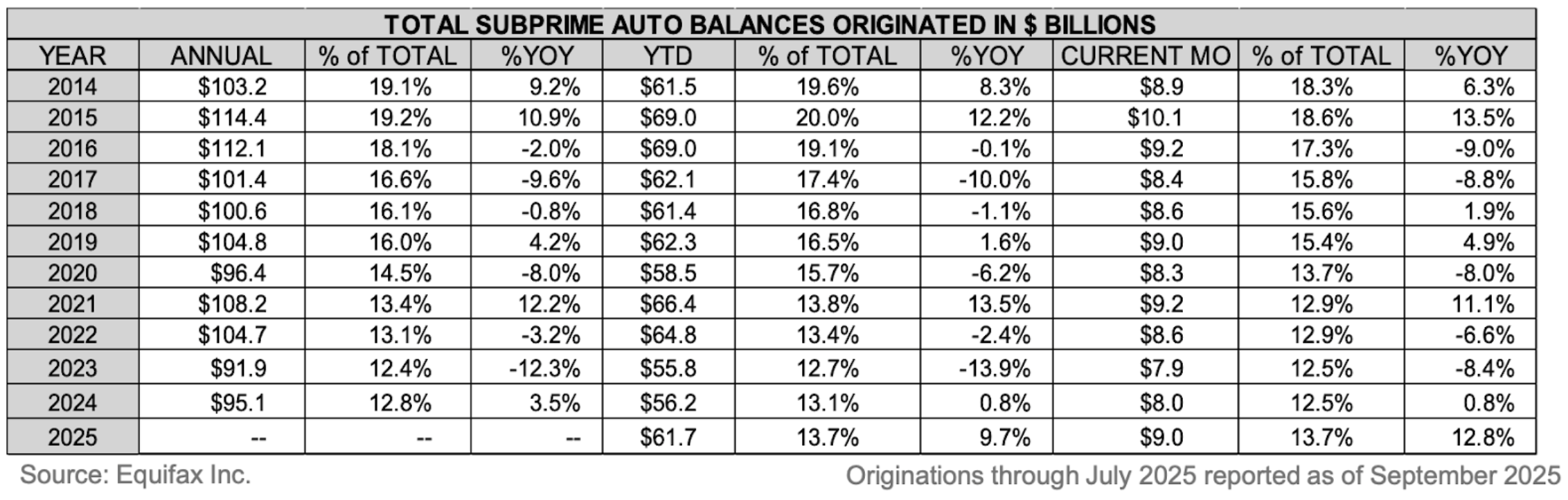

In dollar terms, total US subprime auto originations (defined by credit scores less than 620) have amounted to approximately $100 billion per year for the past decade.

This represents 10-15% of total auto originations in any given year.

Free Sample of 50+ Interviews

Sign up to test our content quality with a free sample of 50+ interviews.

Related Content

Credit Acceptance, Carvana, and U.S. Subprime Auto: Ancillary Product Economics, Advances, and Dealer Incentives

US Auto F&I Advisor

America's Car-Mart: Centralization Strategy, Store Closures & Turnaround Plan

Former Parts Account Manager at Americas Car-Mart

Root Inc: A Potential Data-Driven Advantage

Former Senior Executive at Root

Root Inc: New Partnerships & Quote-and-Bind APIs

Former Product Manager at Root Inc.

© 2024 In Practise. All rights reserved. This material is for informational purposes only and should not be considered as investment advice.